Unlocking Opportunities: Understanding Bank Verification Letters (Contoh Surat Pengesahan Bank)

In an increasingly interconnected world, financial transactions often transcend geographical boundaries. Whether you're applying for a visa, securing a loan, or conducting international business, establishing financial credibility is paramount. This is where the concept of bank verification letters, known as "contoh surat pengesahan bank" in Indonesian, comes into play.

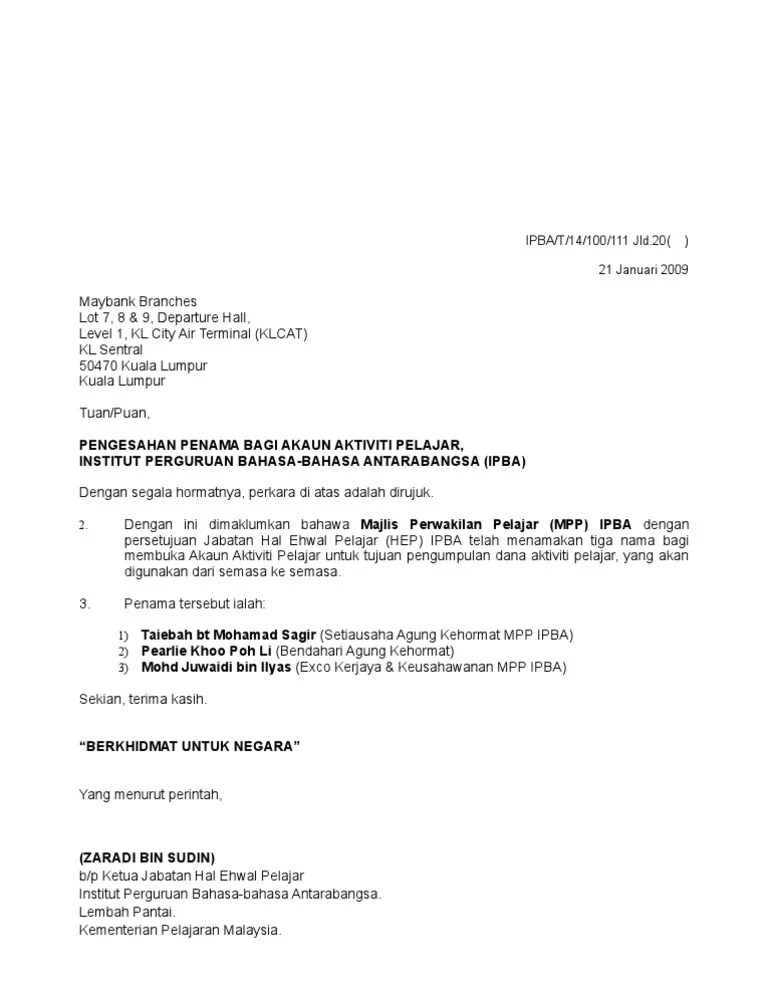

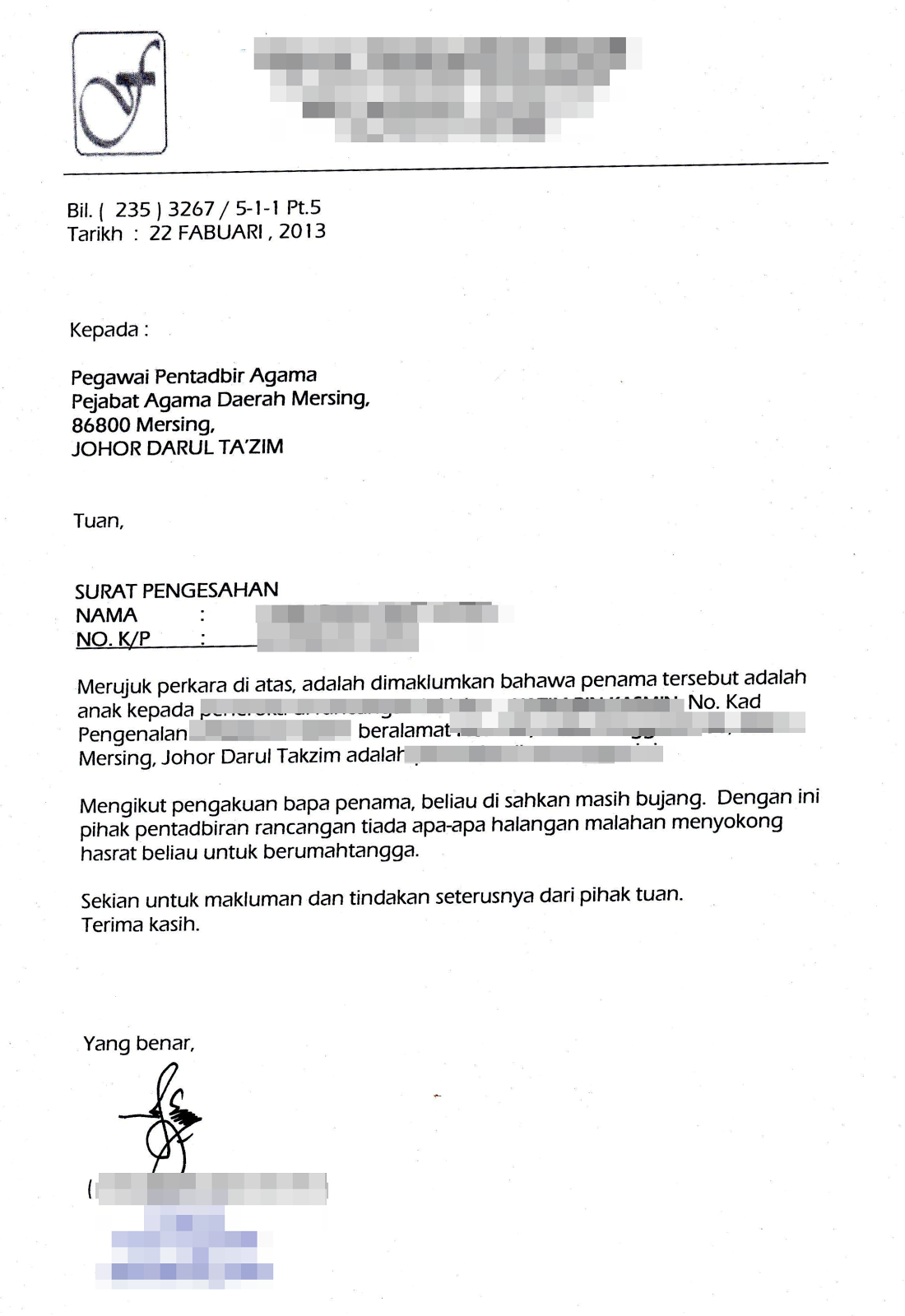

Imagine needing to prove your financial standing to an entity unfamiliar with your financial history. A bank verification letter serves as a formal document from your bank, verifying the existence and status of your account, average balance, and transaction history. It acts as a testament to your financial trustworthiness, bridging the gap between you and institutions requiring financial assurance.

The use of bank verification letters has become increasingly prevalent in our globalized world. They are essential for a myriad of purposes, including visa applications, loan approvals, employment verification, and international trade transactions. The need for these letters stems from the growing demand for standardized proof of financial standing, ensuring transparency and mitigating risks in financial dealings.

Despite their growing importance, there's often confusion surrounding bank verification letters. What information do they contain? How do you obtain one? What are the implications of the information they reveal? This article delves into the intricacies of contoh surat pengesahan bank, equipping you with the knowledge to navigate these processes with confidence.

While bank verification letters offer a layer of trust and transparency in financial dealings, it's crucial to understand the potential sensitivities involved. These letters often disclose personal financial information, raising privacy concerns. It's paramount to ensure you're sharing this information only with legitimate entities and for legitimate purposes. Always verify the recipient's identity and the intended use of the letter before disclosing any personal financial details.

Advantages and Disadvantages of Bank Verification Letters

While bank verification letters offer numerous benefits, it's essential to weigh both the advantages and disadvantages before requesting one.

| Advantages | Disadvantages |

|---|---|

| Enhanced Credibility | Potential Privacy Risks |

| Simplified Financial Processes | Fees and Processing Time |

| International Recognition | Limited Information Disclosure |

Understanding both sides of the coin ensures you make informed decisions regarding your financial documentation.

Navigating the intricacies of financial processes can feel daunting, but understanding the purpose and importance of bank verification letters can simplify these interactions. Whether you're expanding your business globally or pursuing opportunities abroad, a clear understanding of contoh surat pengesahan bank can be your key to unlocking a world of possibilities. By approaching these processes with knowledge and awareness, you can confidently navigate the complexities of international finance and leverage these tools to your advantage.

The enduring charm of tom and jerry a cartoon legacy

Conquer excel cell sizing autofit text like a pro

Unveiling the intrigue of big bang toy cannons value history and more