Unlocking Financial Power Moves: Bank of America Cashier's Checks

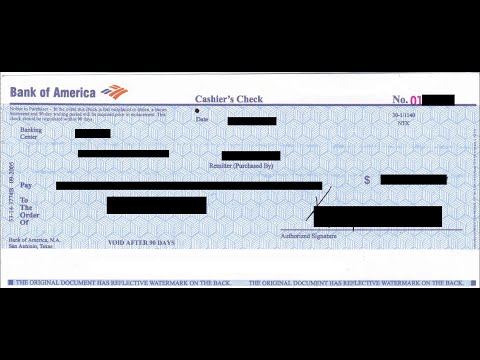

Need to make a large, guaranteed payment? A cashier's check, sometimes called an official check, can be your financial weapon of choice. It's a powerful tool, especially when dealing with big purchases or situations requiring guaranteed funds. This article dives deep into the world of Bank of America cashier's checks, revealing their inner workings and how they can benefit you.

Imagine you're buying a car or making a down payment on a house. Personal checks can raise doubts about sufficient funds, but a cashier's check offers assurance. It's a check drawn directly on the bank's funds, pre-funded by you, making it as good as cash. Bank of America, like many other financial institutions, offers this service, providing a secure way to handle significant financial transactions.

Bank of America cashier's checks function as a promise of payment, backed by the bank itself. Unlike a personal check tied to your individual account balance, a cashier's check is drawn against the bank's own funds, guaranteeing the recipient that the money is available. This makes them highly reliable and widely accepted for large transactions.

Historically, cashier's checks have served as a reliable form of payment for decades, providing a secure alternative to carrying large sums of cash. They have evolved along with banking practices, becoming increasingly accessible with online banking options.

The importance of a Bank of America cashier’s check lies in its guaranteed nature. It offers a layer of security and trust in transactions, reassuring both the payer and the recipient. This is particularly valuable when dealing with large sums of money or when a guaranteed form of payment is required.

Obtaining a Bank of America cashier’s check typically involves visiting a branch, requesting the check, and providing the necessary funds. Some banks, including Bank of America, may offer online options for requesting cashier's checks, streamlining the process for added convenience. Be sure to confirm availability and specific procedures with your local branch or online.

One significant benefit is security. Cashier's checks minimize the risk of fraud, as they are drawn on the bank's funds and are less susceptible to forgery than personal checks.

Another advantage is guaranteed payment. Since the funds are pre-funded, the recipient has assurance that the money is available. This eliminates the risk of bounced checks and simplifies the transaction.

Lastly, cashier's checks offer peace of mind. Knowing the payment is guaranteed provides both parties with a sense of security and confidence in the transaction.

If you’re a Bank of America customer and need a cashier’s check, start by contacting your local branch or checking their website for online options. Determine the necessary amount, gather required identification, and ensure you have sufficient funds available to cover the check and any applicable fees.

Advantages and Disadvantages of Bank of America Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Potential Fees |

| Security and Fraud Prevention | Requires Pre-Funding |

| Widely Accepted | Limited Refund Options if Lost or Stolen |

Frequently Asked Questions:

1. Where can I get a Bank of America cashier’s check? Contact your local branch or check their website for online availability.

2. What information is needed to obtain a cashier’s check? Typically, you will need valid identification and the recipient’s information.

3. Are there fees associated with cashier’s checks? Yes, fees may apply. Contact your branch for details.

4. How do I ensure my cashier's check is legitimate? Verify the check with the issuing bank.

5. What happens if my cashier’s check is lost or stolen? Contact your bank immediately to report the loss.

6. Can I stop payment on a cashier’s check? Contact your bank for specific procedures.

7. How long is a cashier's check valid? Contact your bank for details on validity periods.

8. Can I track my cashier's check? Contact your bank for tracking options.

Tips and Tricks: Keep a copy of your cashier's check receipt. Confirm the recipient’s name and information for accuracy. If you have concerns, contact your branch directly to verify procedures.

In conclusion, Bank of America cashier’s checks provide a secure and reliable method for handling substantial financial transactions. Their guaranteed nature offers peace of mind for both the payer and the recipient, mitigating the risks associated with other payment methods. While fees may apply, the security and assurance they provide often outweigh the costs. By understanding the process of obtaining and using a cashier's check, you can navigate important financial matters with confidence. Take advantage of this valuable tool to simplify your large payments and ensure smooth transactions. Reach out to your local Bank of America branch or explore their online resources for more detailed information and to get started today.

Chevy colorado temperature gauge malfunction a deep dive

Lifes curveballs navigating the qualifying life event period

Mastering the art of sarcasm your guide to frases sobre el sarcasmo