Unlocking Financial Access: Navigating 'Surat Rasmi Pembukaan Akaun Bank'

In a world rapidly embracing digitalization, access to financial services is paramount. This access is often facilitated through a crucial document, especially in many parts of Southeast Asia, known as a 'surat rasmi pembukaan akaun bank' – a formal letter for opening a bank account. This seemingly simple document acts as a gateway, connecting individuals and businesses to a world of financial possibilities.

Imagine needing to secure a loan for your dream business or wanting to save for your child's education. These aspirations often begin with a simple step: opening a bank account. However, the process isn't always straightforward. It involves understanding the local financial landscape and navigating specific requirements, one of which is often the 'surat rasmi pembukaan akaun bank'. This document serves as official communication with the bank, demonstrating your intent and providing essential information for account setup.

While the concept of opening a bank account is universal, the methods and documentation required can differ significantly across countries and regions. In regions like Malaysia, the 'surat rasmi pembukaan akaun bank' holds particular importance. This formal letter is more than just a formality; it's a key that unlocks access to financial stability, growth, and opportunity.

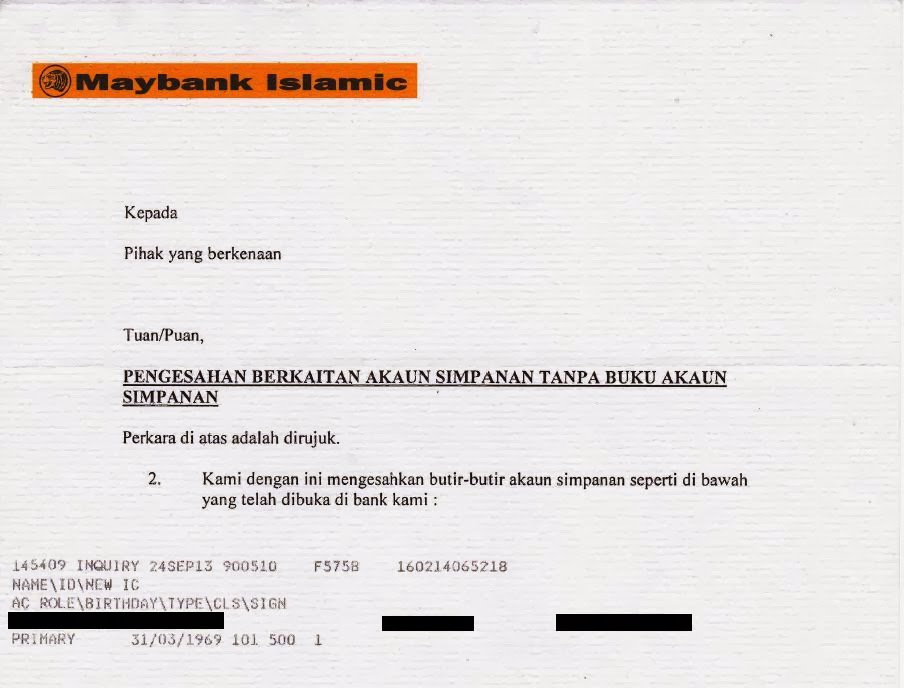

But what exactly constitutes a 'surat rasmi pembukaan akaun bank'? This isn't just any casual letter; it follows a specific format, often outlined by the respective bank. The content typically includes personal information like your full name, address, identification details, employment status, and the type of account you wish to open. Additionally, it may require a signature from your employer or an authority figure to verify your identity and legitimacy.

Navigating the world of finance can seem complex, but understanding the role of crucial documents like the 'surat rasmi pembukaan akaun bank' can simplify the process significantly. In the following sections, we will delve deeper into the specifics of this document, exploring its significance, the information it requires, and how it paves the way for a more secure financial future.

Advantages and Disadvantages of 'Surat Rasmi Pembukaan Akaun Bank'

| Advantages | Disadvantages |

|---|---|

| Provides a formal and standardized way to open an account. | Can be time-consuming to obtain necessary signatures or documentation. |

| Ensures all necessary information is provided to the bank. | May pose a barrier for individuals unfamiliar with formal letter writing. |

| Helps maintain a record of the account opening request. | Could be less efficient than online account opening methods. |

While 'surat rasmi pembukaan akaun bank' serves as a vital tool for accessing financial services, it is essential to acknowledge both its benefits and drawbacks to navigate the process effectively.

In conclusion, 'surat rasmi pembukaan akaun bank' plays a critical role in providing individuals and businesses with access to the financial system. Though it may seem like a procedural step, understanding its importance, format, and requirements can facilitate a smoother and more successful account opening experience.

Unlocking elwood city your guide to pbs kids arthur full episodes

Navigating grief crisp funeral home bryson city experiences

Decoding your boats fuel gauge a comprehensive guide