Simplifying Zakat: Understanding Borang Potongan Gaji Zakat Kedah

Imagine this: it's the end of the year, and you're trying to figure out your finances, including fulfilling your religious obligations. One crucial aspect for Muslims is Zakat, a pillar of Islam that involves giving a portion of one's wealth to those in need. Now, what if there was a system that made this process seamless and hassle-free, directly integrated into your salary? That's essentially what "Borang Potongan Gaji Zakat Kedah" aims to achieve.

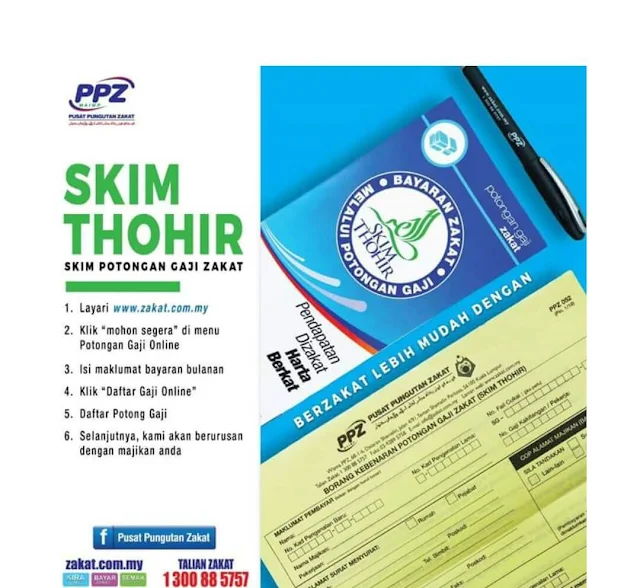

For Muslims residing in Kedah, Malaysia, this phrase is more than just jargon; it represents a simplified way to fulfill their Zakat obligations. "Borang" translates to "form," "Potongan Gaji" means "salary deduction," and "Zakat Kedah" refers to the Zakat institution in Kedah. So, in essence, this form allows for a direct deduction of Zakat from one's salary, making it convenient and systematic.

This system benefits both the giver and the receiver. For individuals, it eliminates the need for manual calculations and payments, ensuring timely and consistent Zakat contributions. On a broader level, the collected Zakat funds are utilized by the Kedah Zakat institution to uplift underprivileged communities, fostering social welfare and economic empowerment.

However, navigating through the details of this form might seem daunting at first. Understanding the eligibility criteria, the calculation methods, and the submission process are crucial to ensuring accurate and efficient Zakat deductions. Whether you are a new employee subject to this system or simply seeking clarity on its workings, this article aims to break down the complexities, providing a comprehensive understanding of "Borang Potongan Gaji Zakat Kedah."

Throughout this guide, we will explore various facets of this system. We'll delve into its historical context, understand the significance of Zakat in Islam, and unpack the specific implications of this automated deduction system. Moreover, we'll address common questions, highlight the benefits, and provide a step-by-step guide to utilizing this system effectively. By the end, you'll be equipped with the knowledge to navigate this process with ease, ensuring both your financial and spiritual obligations are met responsibly.

Advantages and Disadvantages of Borang Potongan Gaji Zakat Kedah

| Advantages | Disadvantages |

|---|---|

| Convenience and Automation | Potential for Errors (if information is incorrect) |

| Consistent Zakat Contributions | Limited Control Over Payment Timing (tied to salary disbursement) |

| Simplified Calculation and Payment | May Not Be Suitable for All Income Types (e.g., freelancers, business owners) |

Even with the convenience, it's important to review your "Borang Potongan Gaji Zakat Kedah" annually or whenever there's a change in your financial situation. Ensure all details are accurate to avoid any discrepancies in your Zakat deductions. Remember, fulfilling Zakat is a significant act of worship, and understanding the mechanisms in place, such as this form, can empower you to participate in this essential pillar of Islam with greater ease and understanding.

Unlocking the mystery your guide to lug nut sizes

Cramps without a period when abdominal pain signals more

Lebron james hand signs

.jpg)