Permohonan Bayaran Balik LHDN: Your Guide to Malaysian Tax Refunds

Have you ever overpaid your taxes in Malaysia? It's a common occurrence, and when it happens, you're entitled to a refund. The process of claiming this refund is known as "Permohonan Bayaran Balik LHDN," which translates to "LHDN Tax Refund Application." Navigating the world of taxes and refunds can seem daunting, but it doesn't have to be. This comprehensive guide will walk you through everything you need to know about Permohonan Bayaran Balik LHDN, empowering you to claim what's rightfully yours.

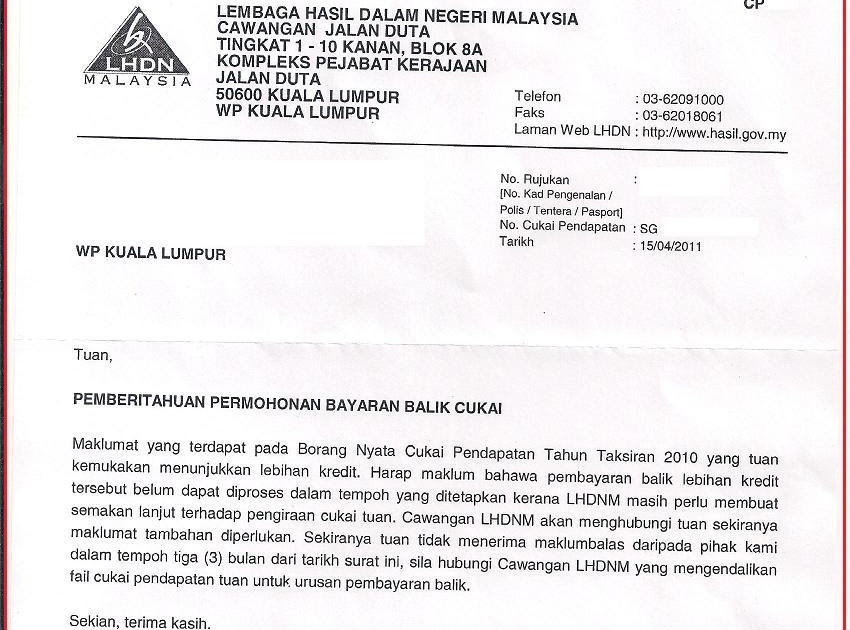

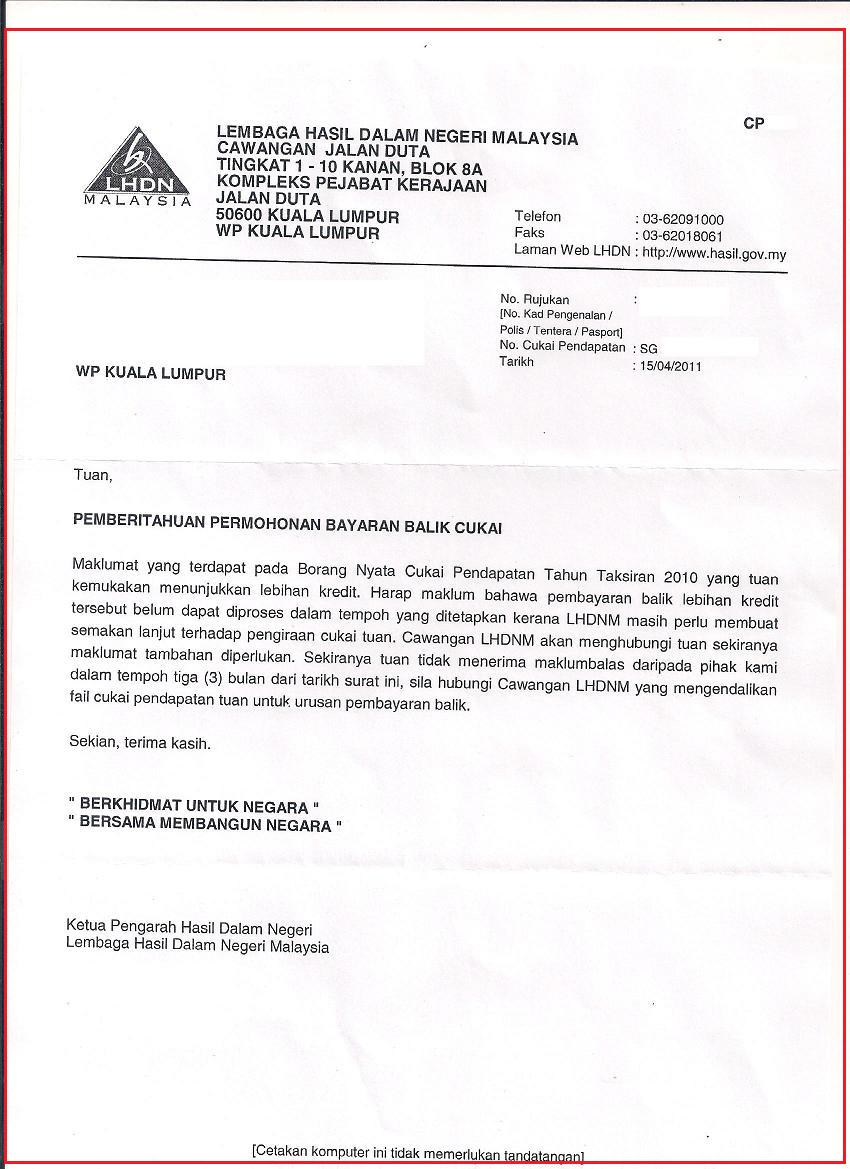

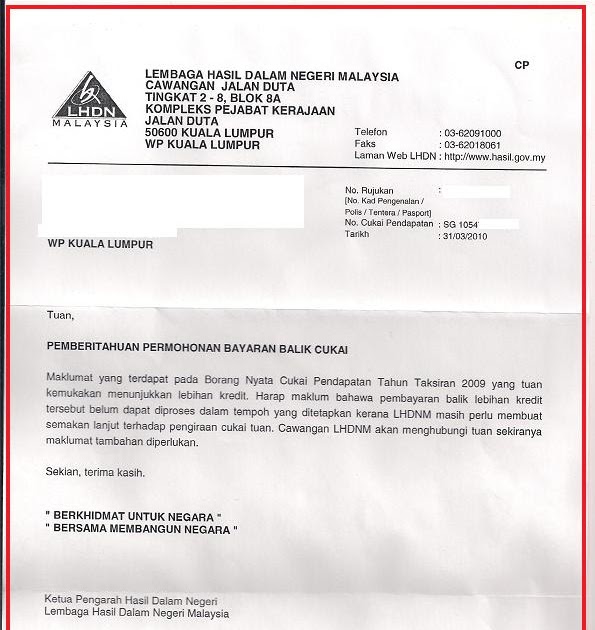

In Malaysia, the Inland Revenue Board (IRB), also known by its Malay name Lembaga Hasil Dalam Negeri (LHDN), manages the country's taxation system. Each year, individuals and businesses are required to file their income tax returns, declaring their income and any eligible deductions or reliefs. The goal is to ensure you've paid the correct amount of tax based on your financial situation.

Now, there are times when you might have paid more taxes than you actually owe. This can happen for various reasons, such as:

- Excess tax deductions from your salary by your employer

- Tax reliefs or rebates that you were eligible for but didn't claim during filing

- Investment income that was already subject to withholding tax

When such situations arise, you have the right to request a refund from LHDN. This is where the Permohonan Bayaran Balik LHDN comes in. It's your formal request to the IRB to review your tax filings and, if applicable, issue a refund for the overpaid amount. Understanding how to navigate this process can save you time and potentially put some extra money back in your pocket.

While the concept of a tax refund might seem straightforward, the actual process of applying for and receiving a Permohonan Bayaran Balik LHDN involves several key aspects. Understanding these aspects is crucial for ensuring a smooth and successful refund claim. We'll delve deeper into the intricacies of this process in the following sections, providing you with the knowledge and tools you need to confidently manage your Malaysian tax refunds.

Advantages and Disadvantages of Permohonan Bayaran Balik LHDN

| Advantages | Disadvantages |

|---|---|

| Receive money you're owed. | Potential for delays in processing. |

| Relatively straightforward process for most cases. | Requires careful record-keeping and documentation. |

Best Practices for Permohonan Bayaran Balik LHDN

To increase your chances of a smooth and successful Permohonan Bayaran Balik LHDN experience, consider these best practices:

- File your tax returns on time: Even if you're due a refund, filing late can lead to delays and complications.

- Keep meticulous records: Maintain organized records of all income, expenses, and tax-related documents. This will be crucial during the application and potential audit processes.

- Double-check your forms: Ensure all information on your tax forms and refund application is accurate and complete. Errors can lead to delays or even rejection of your claim.

- Understand the process: Familiarize yourself with the Permohonan Bayaran Balik LHDN guidelines and procedures. LHDN provides resources on their website, and you can also consult with a tax professional if needed.

- Be patient: LHDN processes a significant volume of tax returns and refund applications. It's essential to be patient and allow sufficient time for processing.

By understanding the process, following the guidelines, and utilizing the provided resources, you can confidently navigate the Permohonan Bayaran Balik LHDN process and potentially receive a refund that is rightfully yours.

Gray cabinets by sherwin williams kitchen alchemy

Level up your discord server the ultimate guide to cool server pfps discord generators

Unlocking enhanced expression exploring discord nitro emoji servers