Navigating Your Golden Years: A Guide to "Cara Isi Borang Pencen"

Retirement. It's a word that evokes a kaleidoscope of emotions: excitement for newfound freedom, anticipation for long-awaited adventures, and perhaps, a touch of anxiety about financial security. For many Malaysians, navigating the path to a comfortable retirement hinges on understanding a crucial process: "cara isi borang pencen," which translates to "how to fill out a pension form." It might sound like a bureaucratic hurdle, but in reality, it's the gateway to unlocking the financial benefits you've diligently earned throughout your working years.

Imagine this: you've dedicated years of hard work, contributing diligently to your pension fund. Now, as retirement approaches, you're faced with the task of ensuring a smooth transition into this new chapter. This is where "cara isi borang pencen" comes into play. It's not just about filling out forms; it's about taking control of your financial well-being and ensuring that your retirement years are truly golden.

The Malaysian pension system, primarily managed by the Employees Provident Fund (EPF), is designed to provide financial security to retirees. Understanding how to navigate the nuances of "cara isi borang pencen" can significantly impact your retirement income and overall financial health. Whether you're nearing retirement or simply planning for the future, grasping this process is paramount.

In a world of digital advancements, the process of "cara isi borang pencen" has evolved. While traditional paper forms might still be available, many prefer the convenience and efficiency of online platforms. Regardless of your chosen method, the fundamental principles remain the same: accuracy, completeness, and a clear understanding of your options.

This comprehensive guide delves into the intricacies of "cara isi borang pencen," equipping you with the knowledge to navigate the process confidently. We'll cover everything from understanding the different pension schemes to common challenges and expert tips for a seamless experience. By the end of this journey, you'll be well-prepared to embrace your retirement years with financial peace of mind.

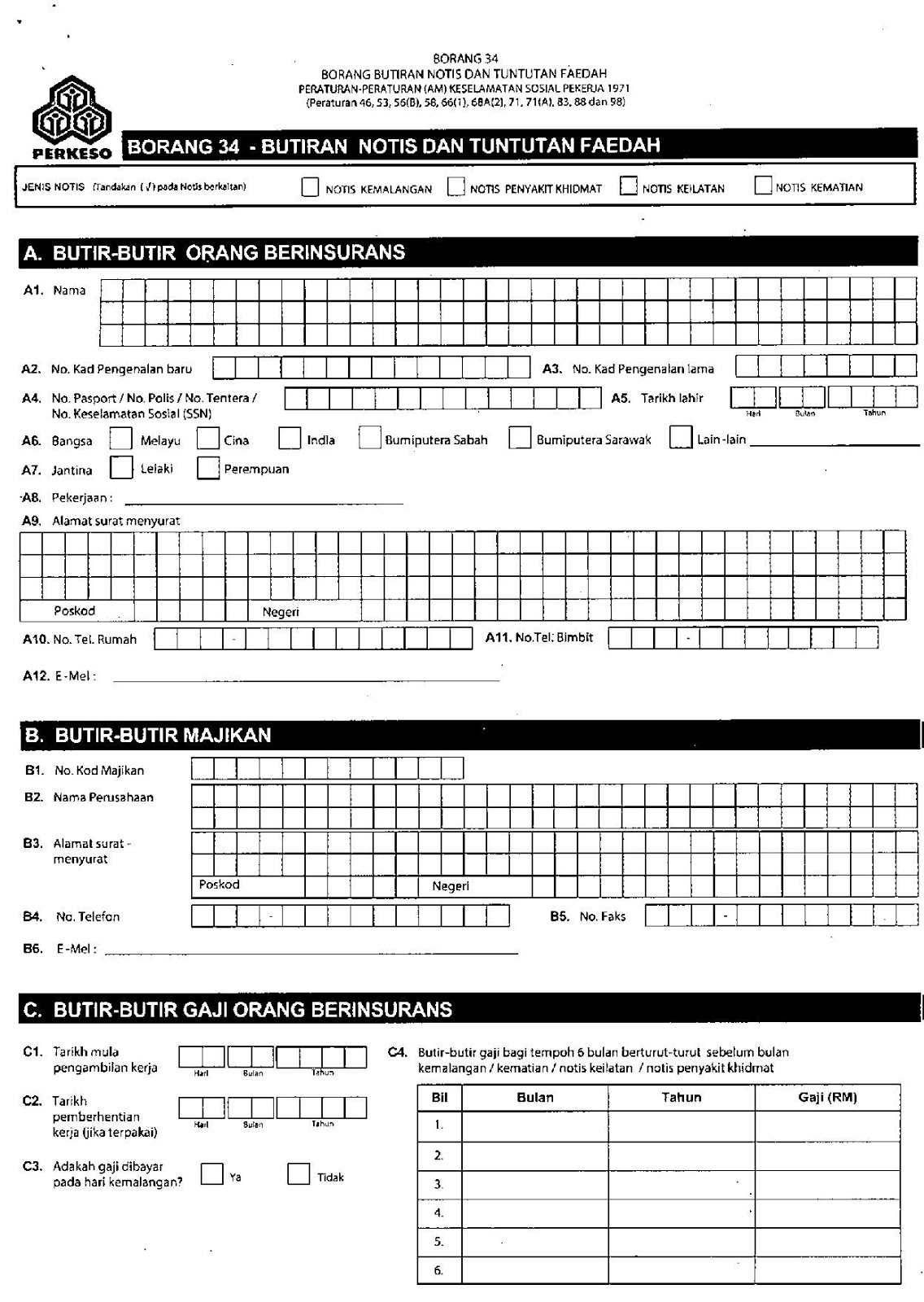

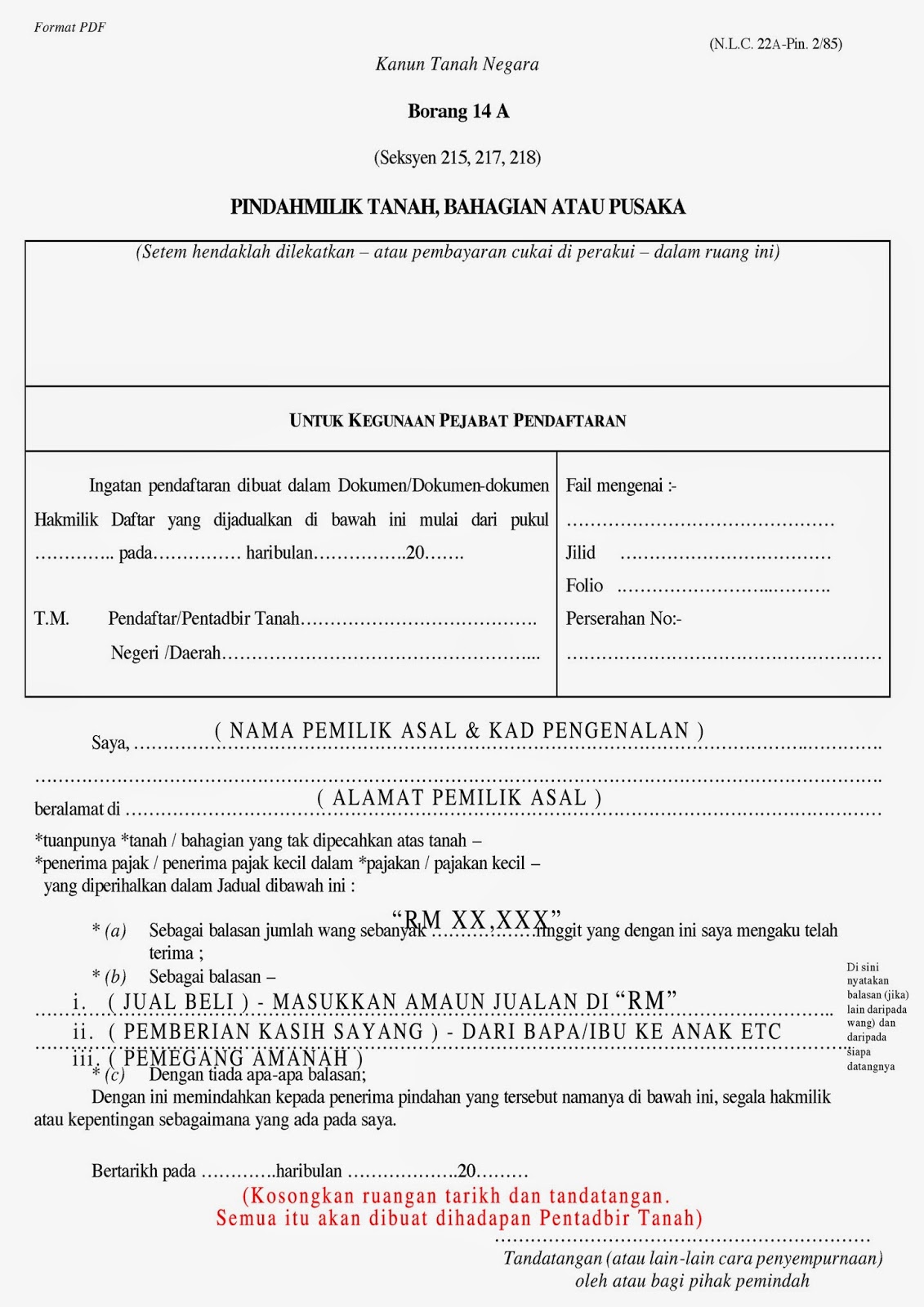

While specific details about the "borang pencen" may vary depending on your employment sector (government or private) and the specific pension scheme you're enrolled in, the fundamental information required generally includes:

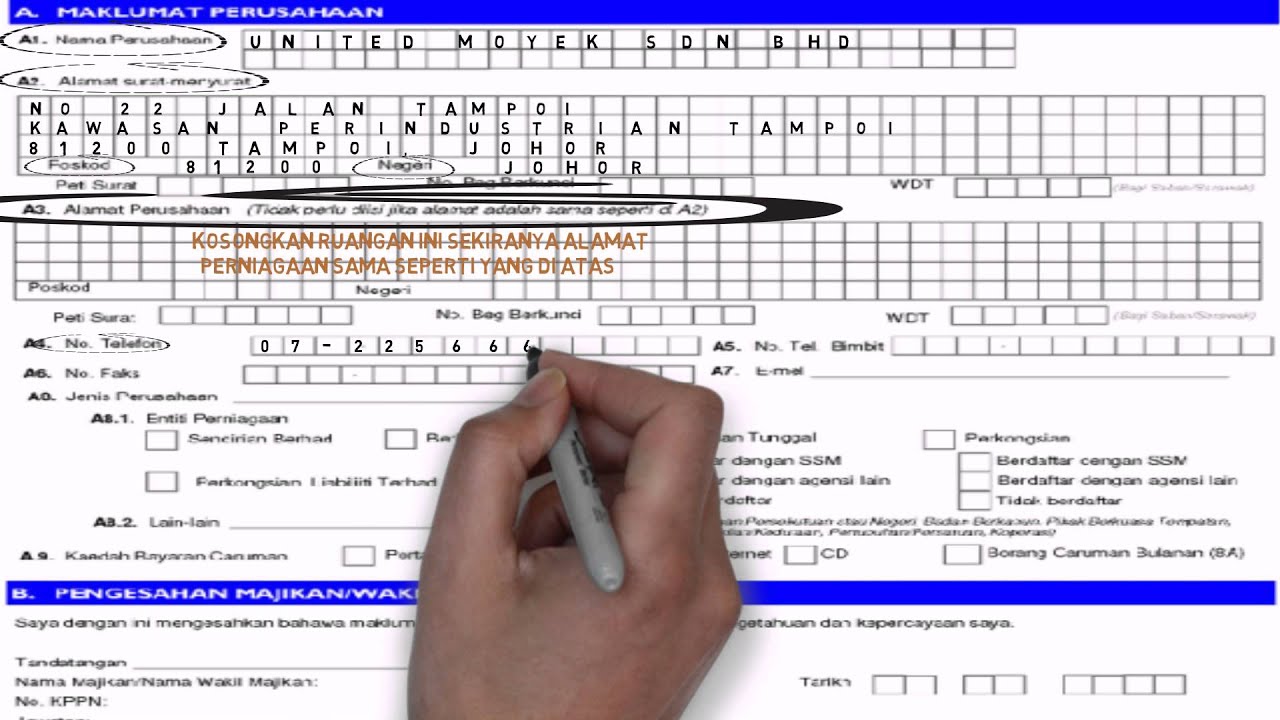

- Personal Information: Full name, IC number, contact details, date of birth, etc.

- Employment History: Details about your employment tenure, employers, and contributions made to the pension fund.

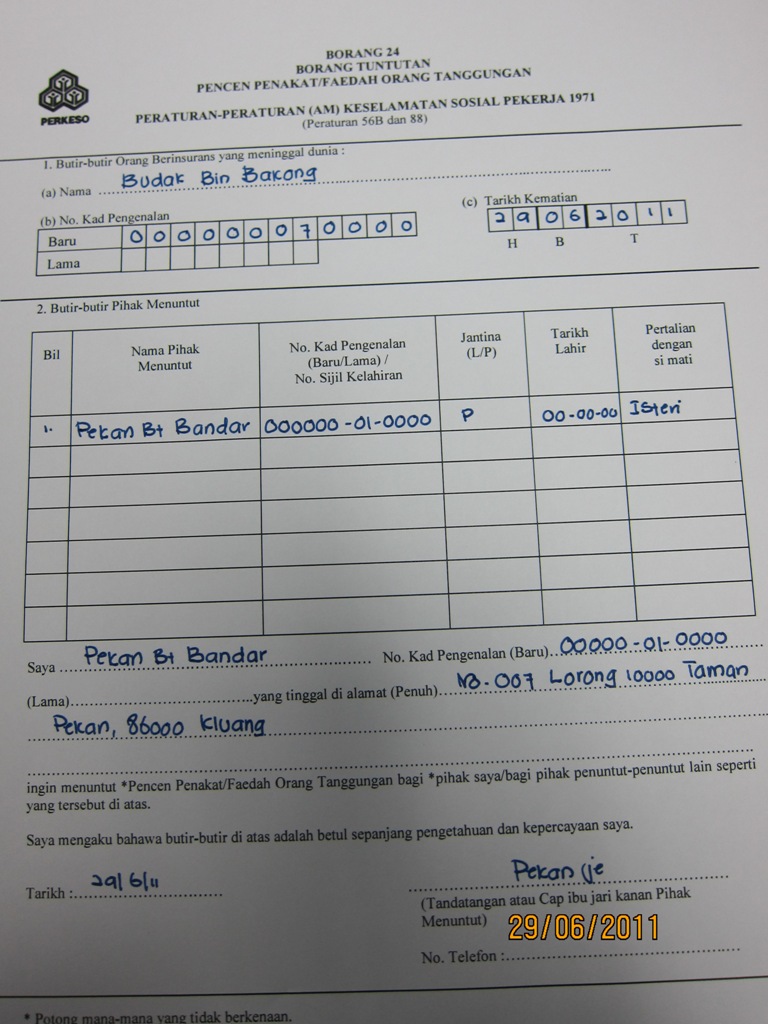

- Beneficiary Details: Information about your nominated beneficiaries who will receive your pension benefits in case of your demise.

- Pension Option Selection: You might be presented with different withdrawal or annuity options for receiving your pension benefits. Understanding these options and choosing the one that aligns with your financial goals is crucial.

Successfully navigating the "cara isi borang pencen" process is your passport to unlocking a world of possibilities in your retirement. It's not just about paperwork; it's about securing your financial future and embracing the freedom to pursue your passions. As you embark on this journey, remember that knowledge is your most valuable asset. Arm yourself with information, seek guidance when needed, and step confidently into your well-deserved retirement.

Unpacking the cultural impact of voy a vivir letra a deep dive

Hyperlite youth life jackets keeping kids safe stylish on the water

Towing capacity of a 1500 everything you need to know