Navigating the PERKESO Contribution Schedule for Foreign Workers in Malaysia

In an increasingly globalized world, Malaysia has become a hub for foreign workers seeking employment opportunities. As the nation thrives on a diverse workforce, ensuring the well-being and social security of all workers, including those from overseas, is paramount. This is where the Social Security Organisation (SOCSO), or PERKESO in Malay, plays a vital role. PERKESO administers a comprehensive social security system that provides financial protection and benefits to workers in Malaysia, including foreign workers.

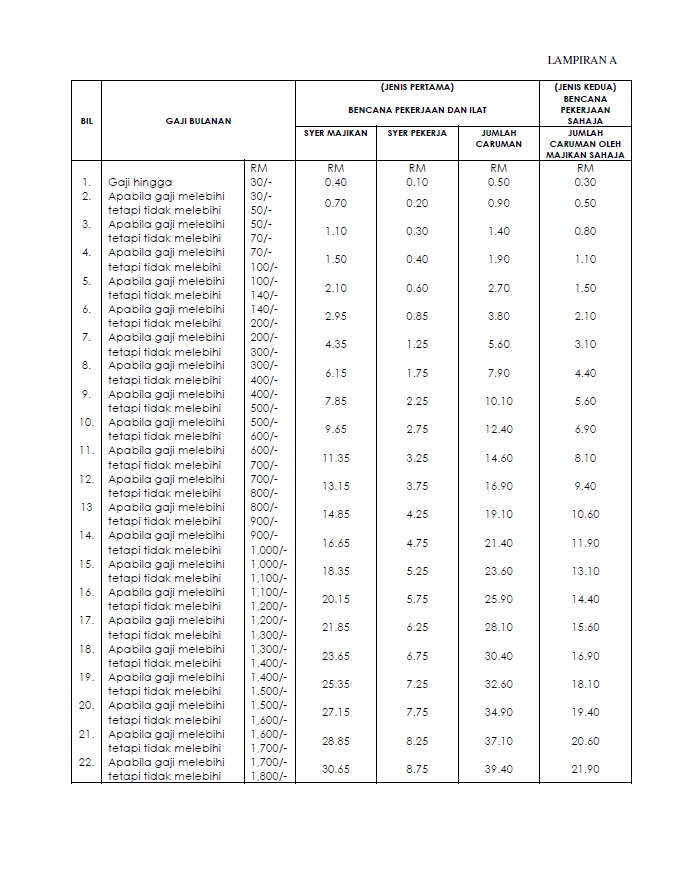

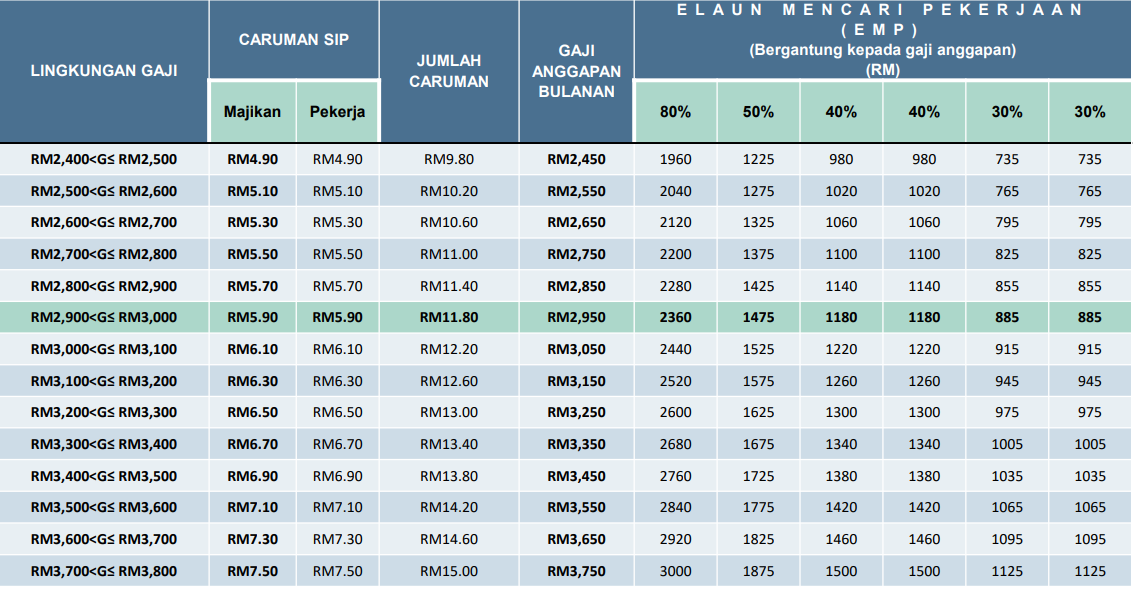

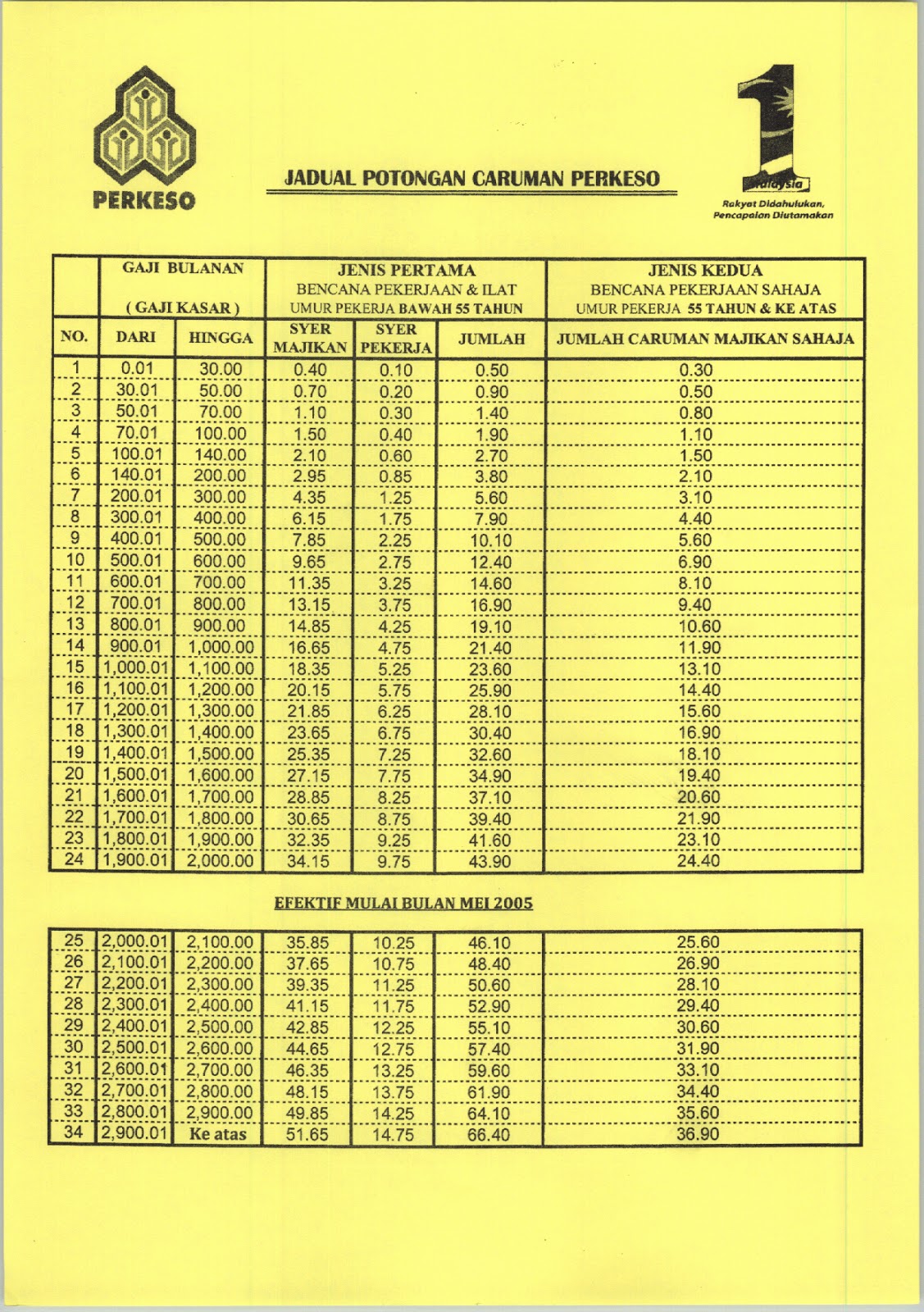

One crucial aspect of PERKESO's operations is the implementation of a clear and structured contribution schedule for foreign workers, commonly referred to as "jadual caruman PERKESO pekerja asing" in Malay. This schedule outlines the specific contribution rates and procedures that employers and foreign workers must adhere to, ensuring compliance with Malaysian labor laws and enabling foreign workers to access the same social security benefits as their Malaysian counterparts.

Understanding the intricacies of the PERKESO contribution schedule for foreign workers is essential for both employers and employees alike. Employers need to navigate the requirements accurately to ensure legal compliance and avoid potential penalties, while foreign workers benefit from understanding their rights and the coverage provided under PERKESO.

This article delves into the significance of the PERKESO contribution schedule, exploring its history, the benefits it offers to foreign workers, and the procedures for making contributions. We will also address common questions and concerns regarding this crucial aspect of social security for foreign workers in Malaysia.

Whether you are an employer seeking clarification on your obligations or a foreign worker aiming to understand your entitlements under PERKESO, this guide will provide valuable insights and practical information to navigate the system effectively.

For employers, complying with the PERKESO contribution schedule is not merely a legal obligation but also a demonstration of ethical responsibility towards their workforce. By ensuring timely and accurate contributions, employers contribute to the well-being of their foreign workers, fostering a more secure and productive work environment.

Advantages and Disadvantages of PERKESO for Foreign Workers

While the PERKESO contribution schedule for foreign workers offers numerous advantages, it is essential to acknowledge potential challenges:

| Advantages | Disadvantages |

|---|---|

| Financial security and protection for foreign workers in case of work-related accidents, illnesses, or invalidity. | Possible language barriers and lack of awareness among foreign workers regarding their rights and benefits under PERKESO. |

| Access to medical treatment and rehabilitation services at SOCSO-panel clinics and hospitals. | Delays in receiving benefits due to administrative processes or language barriers. |

It is crucial to address these challenges proactively through targeted awareness campaigns and accessible resources in multiple languages, empowering foreign workers to fully benefit from the social security net provided by PERKESO.

In conclusion, the PERKESO contribution schedule for foreign workers is a cornerstone of Malaysia's commitment to creating a fair and equitable work environment for all. By understanding the importance of this schedule, both employers and foreign workers can ensure compliance, protect the well-being of the workforce, and contribute to a more inclusive and thriving economy.

Unveiling the enigma the truth about lee min hos relationship status

Maines autumn majesty unveiling the top fall foliage spots

Dominate your fantasy league the ultimate guide to nfl fantasy player news

.png)