Navigating the Labyrinth: Unpacking the Chase Third Party Check Policy

In the intricate world of finance, where trust and security intertwine with every transaction, understanding the rules of engagement becomes paramount. One such facet, often shrouded in layers of complexity, is the realm of third-party checks. These seemingly ordinary instruments, bearing the weight of financial commitment from one individual to another, take on a nuanced character when a third party enters the equation.

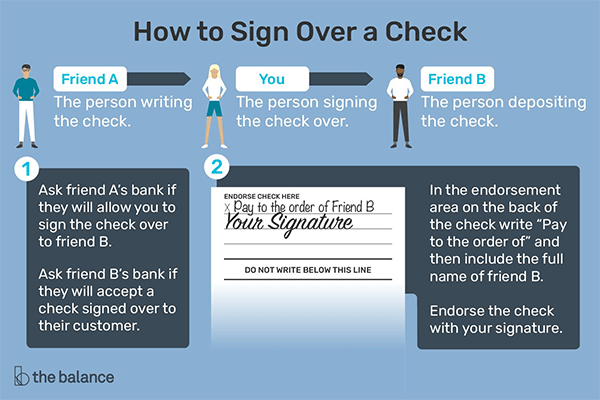

Imagine this: you've sold your beloved vintage record player, and the buyer, unable to meet face-to-face, sends a check from their company's account. You, a Chase customer, head to your local branch, a sense of satisfaction warming you. But as the teller scrutinizes the check, a shadow of doubt creeps in – this isn't a straightforward transaction. This, my friend, is where the Chase third party check policy comes into play, a set of guidelines designed to navigate the delicate balance between facilitating commerce and mitigating risk.

The history of third-party checks is intertwined with the evolution of banking and commerce itself. As trade expanded beyond local bartering, the need for instruments representing value emerged. Checks, initially handwritten promises to pay, became standardized, facilitating transactions across distances. The concept of a third-party check likely arose from the necessity to accommodate more complex business arrangements, allowing for payments from entities other than the individual directly involved.

The importance of a third-party check policy, like the one implemented by Chase, cannot be overstated. It serves as a bulwark against potential fraud, money laundering, and other financial crimes that can exploit the inherent vulnerabilities of these transactions. By establishing clear guidelines and procedures, Chase aims to protect both its customers and the integrity of the financial system.

However, the world of third-party checks isn't without its share of complexities. The very nature of these instruments, involving parties beyond the original issuer and recipient, introduces a layer of uncertainty. Verifying the legitimacy of the check, the identity of the payer, and the purpose of the transaction becomes a multifaceted challenge. This is further compounded by the potential for forgery, altered checks, or even checks issued from accounts with insufficient funds. It is within this landscape that the Chase third-party check policy operates, striving to strike a delicate balance between enabling legitimate transactions and safeguarding against potential risks.

While a detailed exploration of Chase's specific policy is best left to their official documentation, understanding the broader context and potential issues surrounding third-party checks is crucial for anyone engaging in such transactions. Familiarity with common red flags, such as requests to cash checks for strangers or discrepancies in the check's information, can empower individuals to protect themselves from becoming victims of fraud.

Elevate your bathing ritual mastering the art of bathtub shower faucet replacement

Chicano gangster cursive tattoo a story etched in ink

Unleash your creativity the magic of foam letter templates