Navigating the Importance of "Surat Pengesahan Akaun Bank" (Bank Account Verification Letter)

In an increasingly digital world, financial transactions often demand a higher level of verification. This is particularly true in Malaysia, where the "surat pengesahan akaun bank," or bank account verification letter, plays a crucial role in various processes. But what exactly is it, and why is it so important?

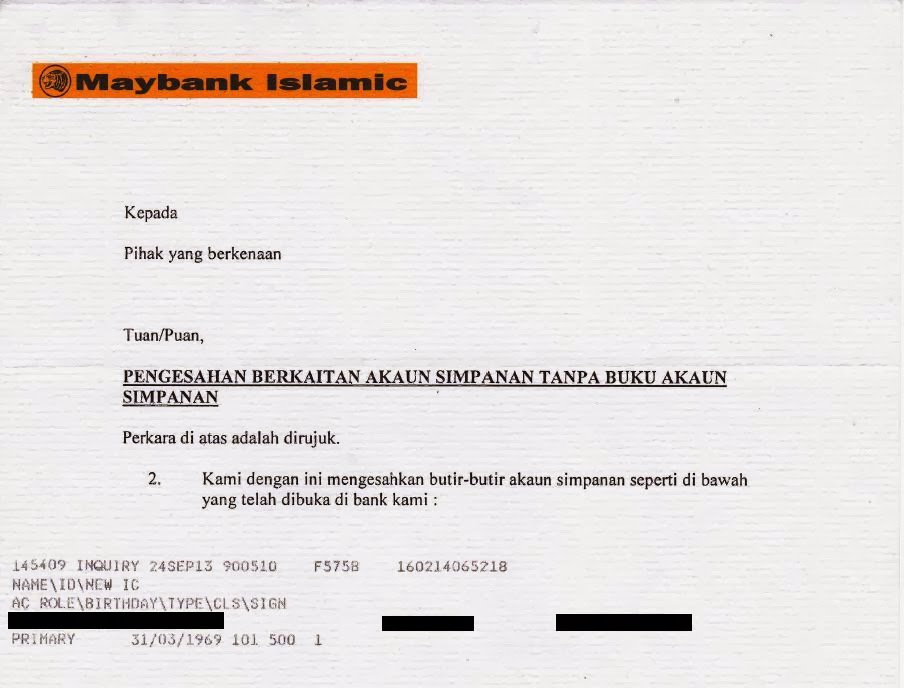

Simply put, a "surat pengesahan akaun bank" is an official document issued by your bank that confirms the existence and active status of your bank account. This letter typically includes key details such as your full name, account number, account type, and the date the letter was issued. Think of it as your bank account's "proof of life" in the financial world.

The need for this document might seem like an added layer of bureaucracy, but its importance cannot be overstated. It acts as a safeguard against fraud and identity theft, ensuring that financial transactions are conducted with legitimate account holders. Imagine applying for a loan, receiving a salary payment from a new employer, or even claiming insurance – these situations often require proof of your banking details, which is where the "surat pengesahan akaun bank" comes in.

While the history and origins of this document are intertwined with the evolution of banking practices in Malaysia, its significance has only grown in the digital age. With the rise of online transactions and the increasing need to verify identities, the "surat pengesahan akaun bank" has become a cornerstone of secure and trustworthy financial activities.

However, like any system involving sensitive information, there are potential issues surrounding the use of "surat pengesahan akaun bank." These range from concerns about data privacy and security to the potential for forgery or misuse. This underscores the importance of understanding the document, its purpose, and how to obtain and use it safely and responsibly.

Advantages and Disadvantages of "Surat Pengesahan Akaun Bank"

Let's weigh the benefits and drawbacks to get a clearer picture:

| Advantages | Disadvantages |

|---|---|

| Increased security and fraud prevention | Potential for misuse if the document falls into the wrong hands |

| Streamlined financial transactions and verifications | Time-consuming to obtain, requiring a visit to the bank or an online request |

| Builds trust and credibility in financial dealings | Limited validity period, often requiring frequent requests for updated letters |

Despite the disadvantages, the benefits of "surat pengesahan akaun bank" outweigh the risks, making it a vital component of financial security in Malaysia.

Best Practices for Using "Surat Pengesahan Akaun Bank"

- Request the letter directly from your bank: Always obtain the document from your bank branch or through their official online banking platform.

- Verify the information carefully: Double-check all details on the letter for accuracy, including your name, account number, and the date of issue.

- Understand the purpose and share cautiously: Only provide the letter to legitimate institutions and individuals who require it for a specific, valid reason.

- Handle the document with care: Treat it like any other important financial document and store it securely to prevent unauthorized access.

- Dispose of it properly: Once the purpose of the letter has been served, shred or destroy it securely to prevent information theft.

Navigating the complexities of financial systems might seem daunting, but understanding the role of documents like "surat pengesahan akaun bank" empowers individuals to engage confidently and securely. By being aware of its significance, adhering to best practices, and staying vigilant, you can navigate the financial landscape with greater awareness and peace of mind.

Your gangster name discover your inner mobster

Unlock your pharmacy career navigating indonesian pharmacy schools

Can you own a cannon legality of cannon ownership