Navigating Indonesian Payroll: Understanding Employee Income Tax (PPh 21)

In the intricate tapestry of global commerce, understanding the nuances of each nation's tax system is paramount. For businesses operating within Indonesia's vibrant economy, accurately calculating and withholding employee income tax, known as PPh 21, is not just a legal obligation, it's a cornerstone of ethical and sustainable business practice. This system ensures that employees contribute their fair share to the nation's development while receiving the full benefits they are entitled to.

Imagine a bustling Jakarta office, a symphony of ringing phones and clicking keyboards. Amidst this energetic hum, lies a crucial process, often overlooked amidst the day-to-day hustle: the meticulous calculation of employee salaries, factoring in the complexities of PPh 21. It's a process that requires precision, a deep understanding of Indonesian tax regulations, and a commitment to fairness for both the employer and the employee.

The significance of PPh 21 calculations cannot be overstated. It represents a vital source of revenue for the Indonesian government, funding essential public services that benefit all citizens. From infrastructure projects to healthcare initiatives, education programs to social welfare, the taxes diligently deducted from employee salaries contribute directly to Indonesia's ongoing growth and prosperity.

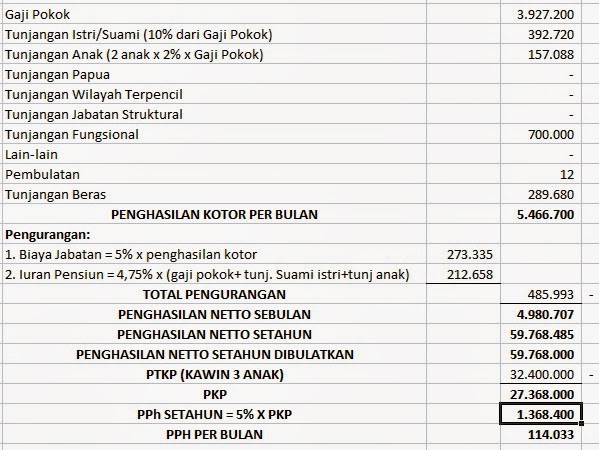

However, navigating the intricacies of PPh 21 can be a daunting task, particularly for businesses new to the Indonesian market. The regulations are comprehensive, encompassing various income brackets, allowances, deductions, and exemptions, each with its own set of stipulations. A lack of clarity in this area can lead to errors in calculation, resulting in potential non-compliance issues, financial penalties, and even reputational damage for the company.

This is where a comprehensive understanding of PPh 21 becomes indispensable. By equipping themselves with the necessary knowledge and tools, businesses can ensure accurate tax deductions, fostering a culture of compliance, transparency, and trust with their employees. Moreover, a thorough grasp of PPh 21 empowers businesses to optimize their payroll processes, streamline administrative burdens, and ultimately, focus on what truly matters: driving their business forward in Indonesia's dynamic and evolving economic landscape.

Advantages and Disadvantages of the Indonesian PPh 21 System

| Advantages | Disadvantages |

|---|---|

| Supports government revenue for public services. | Can be complex to calculate for various income levels and deductions. |

| Promotes fairness and social responsibility in taxation. | Requires constant updates and adaptation to changing regulations. |

| Provides transparency and accountability in salary processing. | May pose challenges for businesses unfamiliar with Indonesian tax law. |

While the nuances of PPh 21 calculation can seem intricate, remember that resources abound to guide you through the process. Tax consultants specializing in Indonesian regulations can provide expert advice tailored to your specific business needs. Online resources, including the official website of the Indonesian Directorate General of Taxes, offer a wealth of information on PPh 21, from legal updates to comprehensive guides.

As you navigate the world of Indonesian payroll and PPh 21, keep in mind that accuracy, compliance, and a commitment to understanding the system are key. By embracing these principles, your business can thrive in Indonesia, fostering growth, contributing to the nation's development, and ensuring a fair and equitable system for all.

Empowering choices your guide to sexual and reproductive health projects

Elevate your designs with a celestial touch exploring light blue glow pngs

Decoding the flour pound to cup conversion