Navigating Financial Streams: Understanding the Wells Fargo Check Mobile Deposit Limit

In the tapestry of modern life, where the rhythm of finance dictates the cadence of our days, we find ourselves constantly seeking ways to navigate its intricate patterns. Like a perfectly tailored suit, our financial tools should be both elegant and efficient, seamlessly blending into the fabric of our lives.

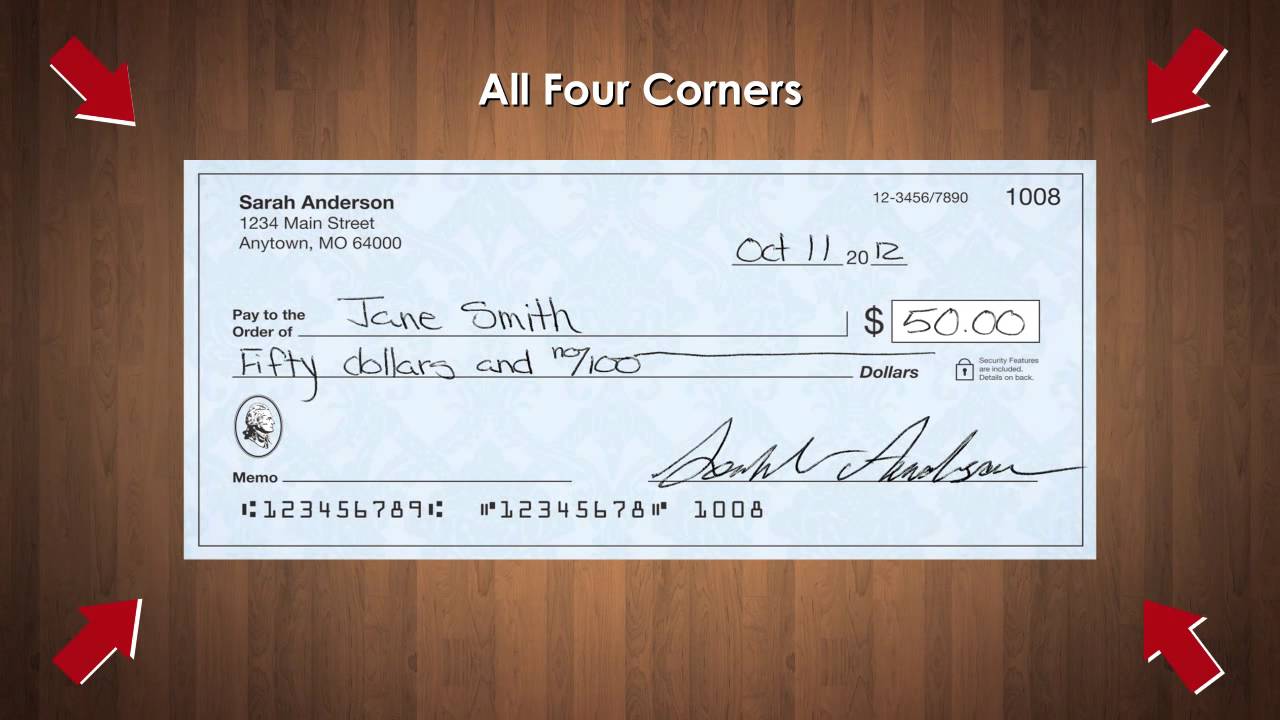

Among these essential tools, mobile banking has emerged as a cornerstone, allowing us to manage our finances with a flick of the wrist. The ability to deposit checks with a simple snapshot, a convenience once unimaginable, has become a cornerstone of this digital revolution. Yet, as with any finely crafted instrument, there are nuances, limitations that shape its use.

Wells Fargo, a name synonymous with banking, offers its own iteration of this modern marvel - mobile check deposit. A boon for many, this feature comes with its own set of parameters, most notably the Wells Fargo check mobile deposit limit. This seemingly simple concept, often overlooked amidst the allure of instant transactions, plays a crucial role in shaping our financial interactions.

Imagine this: you receive a check, perhaps for a freelance project or a birthday gift. Eager to access these funds, you reach for your phone, ready to utilize the magic of mobile deposit. But what happens when the amount exceeds the prescribed limit? Suddenly, this seamless process encounters a hurdle, a reminder that even in the digital age, there are boundaries to consider.

Understanding the Wells Fargo check mobile deposit limit is not merely about adhering to banking regulations. It's about recognizing the delicate balance between convenience and security, between the immediacy of modern technology and the prudence of responsible financial management. It's about knowing the threads that weave together our financial fabric, ensuring its resilience and longevity.

Advantages and Disadvantages of Wells Fargo Check Mobile Deposit Limit

| Advantages | Disadvantages |

|---|---|

| Convenience of depositing checks anytime, anywhere | Potential deposit limits, especially for large checks |

| Faster access to funds compared to traditional deposits | Risk of exceeding the limit and needing alternative deposit methods |

Navigating the world of finance, particularly in the digital age, requires a discerning eye, a keen awareness of both the opportunities and the constraints that come with the territory. Just as a well-dressed individual understands the subtle nuances of tailoring and fit, so too must we approach our financial lives with a similar level of awareness. The Wells Fargo check mobile deposit limit, while seemingly a minor detail, serves as a reminder of this delicate balance, encouraging us to approach our financial interactions with both enthusiasm and prudence.

The curious case of the happy face meme

Diving deep uncovering the importance of water pollution worksheets

Finding the perfect fit understanding average sitting height