Mastering Partial Month Salary Calculation

Navigating the intricacies of payroll can be challenging, especially when dealing with partial months of employment. Whether it's due to a new hire, termination, or unpaid leave, calculating salaries accurately for incomplete months is crucial for maintaining transparency, fairness, and legal compliance.

Unlike standard payroll calculations, partial month salary calculation requires careful consideration of various factors. These factors can include the employee's start date, end date, salary structure, benefits, applicable deductions, and the company's payroll policy. Overlooking even a seemingly minor detail can lead to discrepancies in pay, potentially causing dissatisfaction among employees and even legal ramifications for the employer.

The importance of precise partial month salary calculation cannot be overstated. For employees, it ensures they receive the correct compensation for the time they've worked, instilling trust and confidence in their employer. For businesses, accurate calculations are vital for maintaining financial integrity, complying with labor laws, and fostering a positive work environment.

While the specific regulations and methods may differ based on location and company policies, the underlying principles remain consistent: fairness, accuracy, and transparency. By understanding the nuances of partial month salary calculations, both employers and employees can navigate these situations with clarity and confidence.

This comprehensive guide will delve into the intricacies of calculating salaries for incomplete months, providing you with the knowledge and tools to ensure both accuracy and fairness in your payroll processes.

Advantages and Disadvantages of Calculating Salaries for Incomplete Months

| Advantages | Disadvantages |

|---|---|

| Ensures fair compensation for employees | Can be complex and time-consuming to calculate |

| Maintains legal compliance | Potential for errors if not calculated correctly |

| Promotes transparency and trust | May require specialized software or expertise |

| Simplifies budgeting and financial forecasting | Can be challenging to track and manage for large workforces |

Best Practices for Calculating Salaries for Incomplete Months

1. Establish a Clear Payroll Policy: Begin by outlining a comprehensive payroll policy that explicitly addresses how salaries for incomplete months will be calculated. This policy should be easily accessible to all employees.

2. Determine the Calculation Method: Choose a consistent method for calculating partial month salaries. Common approaches include the calendar day method, working day method, or a hybrid approach.

3. Track Time Accurately: Implement a reliable time tracking system to accurately record employee work hours, especially for those with variable schedules or who have taken unpaid leave.

4. Account for Prorated Benefits: If applicable, ensure that benefits such as paid time off, sick leave, and insurance premiums are prorated accurately for employees working partial months.

5. Review and Double-Check Calculations: Before finalizing payroll, carefully review all calculations to minimize the risk of errors. Consider implementing a system of checks and balances to ensure accuracy.

Frequently Asked Questions (FAQs)

1. How is salary calculated for an incomplete month?

Salary calculation for an incomplete month depends on the company's policy and the employee's agreement. Common methods include calculating daily or hourly rates based on the full monthly salary.

2. What factors can affect partial month salary calculations?

Factors include the employee's start/end date, salary structure, unpaid leave, and company policy.

3. Are there legal requirements for calculating partial month salaries?

Yes, labor laws in most countries have specific regulations regarding salary calculations, including those for incomplete months.

4. What are the common challenges in calculating salaries for incomplete months?

Challenges include tracking employee time accurately, handling prorated benefits, and ensuring compliance with legal requirements.

5. What are the implications of inaccurate partial month salary calculations?

Inaccurate calculations can lead to legal disputes, employee dissatisfaction, and financial discrepancies for the company.

6. Are there software solutions for simplifying partial month salary calculations?

Yes, numerous payroll software solutions are available to automate and simplify these calculations.

7. What should employees do if they believe their partial month salary is incorrect?

Employees should first consult their company's payroll policy and then address any concerns with their HR or payroll department.

8. How can companies ensure transparency in partial month salary calculations?

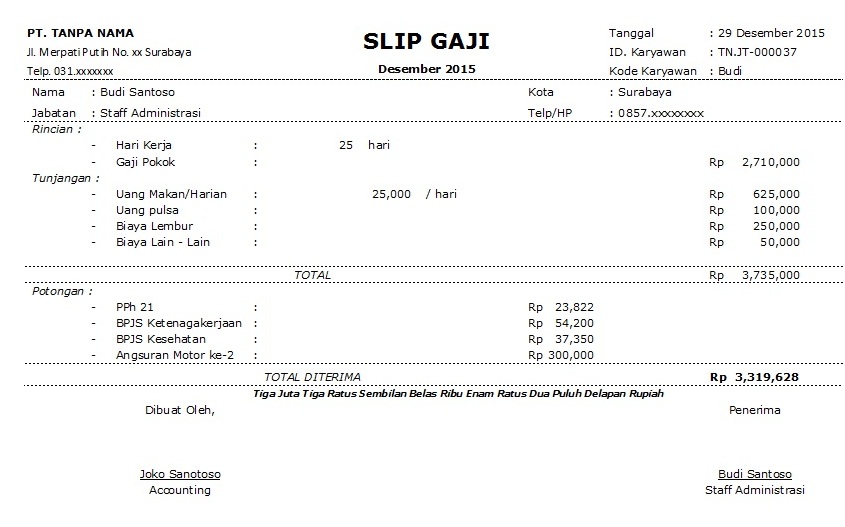

Transparency can be achieved by clearly communicating the calculation method to employees, providing detailed payslips, and offering channels for addressing concerns.

Tips and Tricks

* Maintain clear documentation of employee start and end dates.

* Utilize payroll software or spreadsheets to streamline calculations.

* Regularly review and update your payroll policies to reflect current regulations.

* Provide training to HR and payroll staff on accurate partial month salary calculations.

* Consider seeking professional advice from a payroll expert or labor law consultant.

In conclusion, effectively managing partial month salary calculations is crucial for maintaining fairness, transparency, and legal compliance in any business. While the process may seem daunting, following best practices, utilizing available resources, and prioritizing clear communication can greatly simplify the process. Remember that accurate and timely payments are not only a legal obligation but also a key factor in fostering a positive and trusting work environment.

Unlock your potential reading comprehension practice for adults

Keeping your vessel afloat a guide to the seaflo sfbp1 g800 03 bilge pump

Exploring grayson county kentucky through maps