Kaedah Bayaran Balik Lebihan Cukai: Your Guide to Tax Refunds in Malaysia

We all love a little something extra back in our pockets, don't we? Especially when it comes to something as essential as taxes. In Malaysia, the system for getting back any overpaid taxes is called "kaedah bayaran balik lebihan cukai," essentially meaning "methods of tax overpayment refund." Now, while it might sound like something you'd rather avoid thinking about, understanding how your tax refunds work can be quite empowering.

Think about it – a little extra cash flow never hurt anyone! Whether you're planning a much-needed vacation, finally investing in that designer bag you've had your eye on, or simply want to be smart about your finances, knowing how to navigate the world of tax refunds is key. After all, it's your hard-earned money we're talking about!

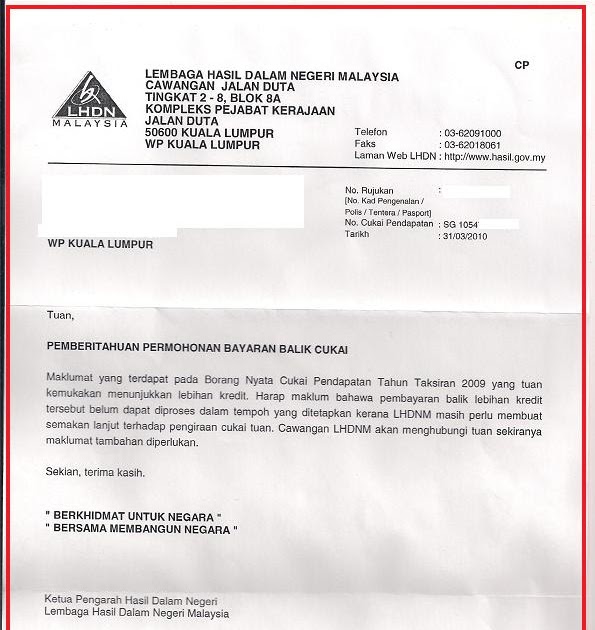

So, how does this whole system work, you ask? Well, in Malaysia, if you've paid more taxes than you owe (yay to you!), the Inland Revenue Board (LHDN) typically offers a few different ways to receive your refund. We'll delve deeper into those options a little later. But first, let's unravel some of the reasons why you might be eligible for a refund in the first place.

There are a few common scenarios where you might find yourself in line for a tax refund. Maybe you switched jobs during the year, and your employer deducted taxes based on your annual income, not realizing you wouldn't be working there for the entire year. Or perhaps you made significant charitable donations or invested in specific tax-relief schemes.

Whatever the reason, one thing is for sure: understanding the various "kaedah bayaran balik lebihan cukai" is essential to ensure you receive your refund promptly and efficiently. Stay tuned as we break down the different refund methods, eligibility criteria, and everything else you need to know to master your Malaysian tax game.

Advantages and Disadvantages of Different "Kaedah Bayaran Balik Lebihan Cukai" Methods

While we haven't delved into the specific methods yet, let's compare their general pros and cons:

| Method | Advantages | Disadvantages |

|---|---|---|

| Direct Bank Transfer |

|

|

| Check/Bank Draft |

|

|

| Credit to Tax Account |

|

|

Best Practices for a Smooth Tax Refund Process

Here are some general tips to make your tax refund experience as seamless as possible:

- File your taxes on time: Don't procrastinate! Filing early can lead to faster refunds.

- Double-check your information: Errors can lead to delays, so accuracy is crucial.

- Choose your preferred refund method wisely: Consider the pros and cons discussed above.

- Keep your contact information updated: This ensures the LHDN can reach you if needed.

- Be patient: Refund processing times can vary, so allow for a reasonable timeframe.

While navigating the world of "kaedah bayaran balik lebihan cukai" might seem daunting at first, it's a process well worth understanding. Remember, knowledge is power, especially when it comes to your finances. By staying informed and following these tips, you can ensure a smooth and efficient tax refund experience, leaving you free to focus on what truly matters – enjoying that extra cash flow!

Small bathroom with bathtub remodel ideas big style in a tiny space

Decoding the inverted smile understanding the upside down emoji

Unlocking your walmart gift card balance a complete guide