Effortless Payroll: Mastering Salary Calculation in Excel

As anyone who's ever managed payroll knows, it's a crucial but often time-consuming task. Between tracking hours, calculating taxes, and ensuring everyone's paid accurately, it can feel overwhelming. But what if there was a way to streamline the entire process, making it not just easier, but more efficient and less prone to errors? That's where the magic of Excel comes in.

For years, businesses large and small have turned to spreadsheets to handle their payroll needs, and for good reason. Excel provides a flexible and powerful platform for organizing employee data, automating calculations, and generating reports. But knowing where to start can be daunting. That's why we're diving deep into the world of salary calculation in Excel, giving you the tools and knowledge to conquer your payroll with confidence.

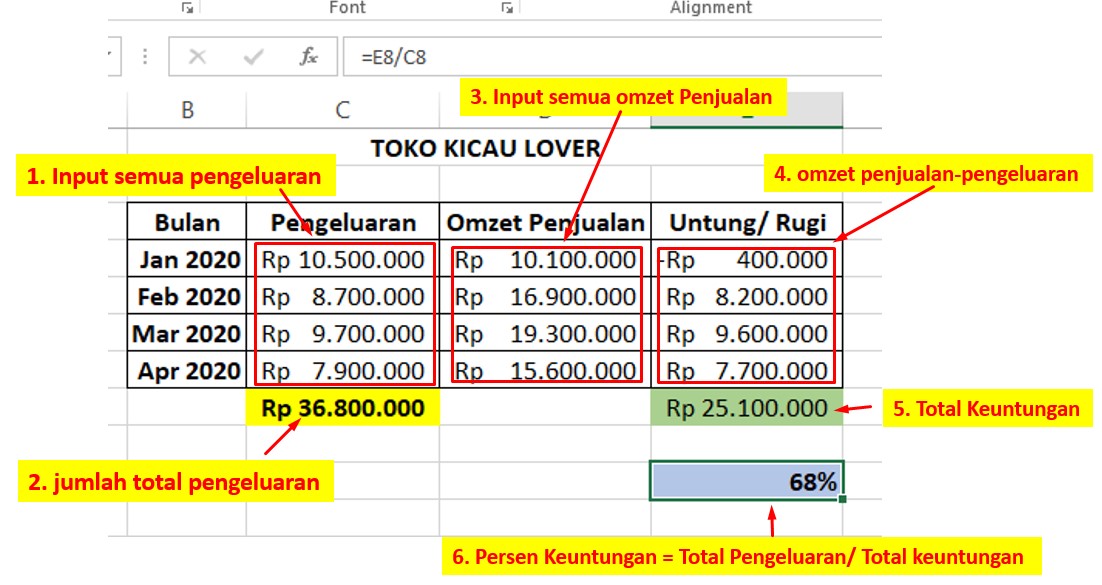

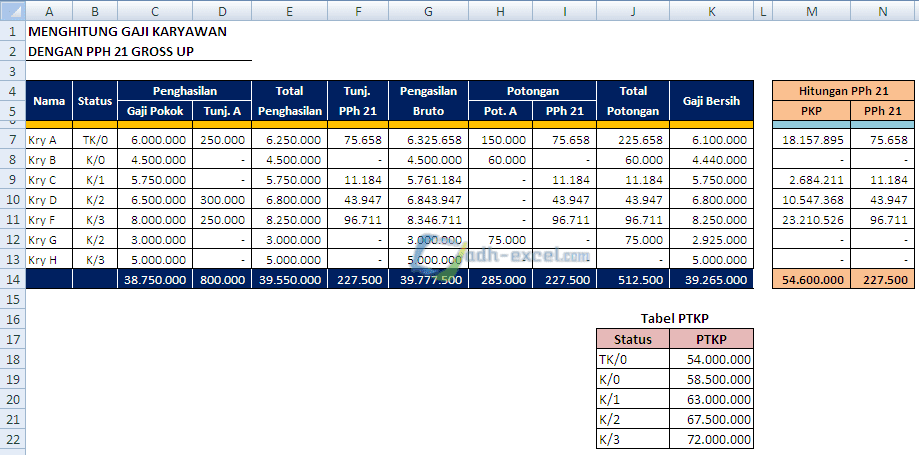

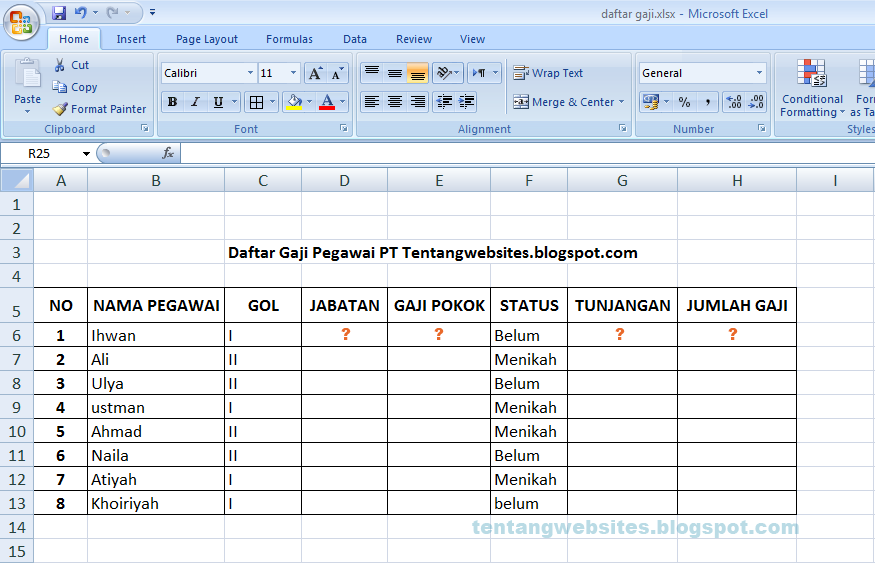

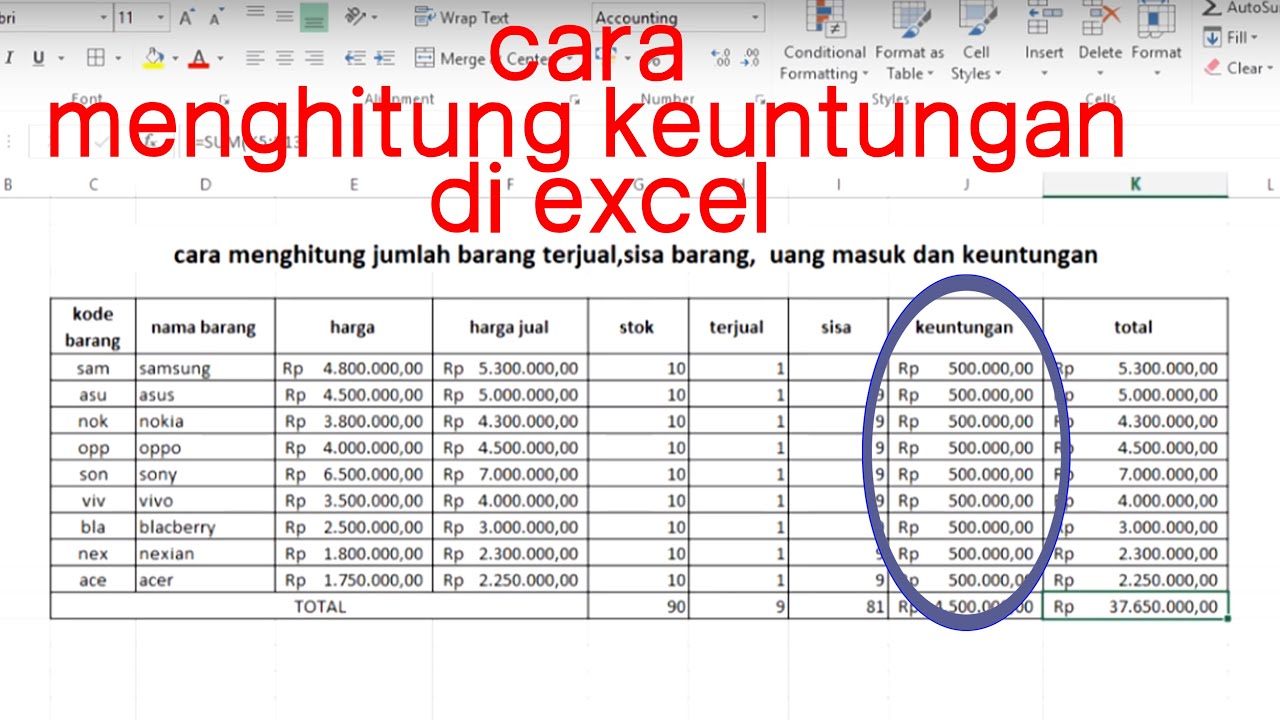

The beauty of using Excel for payroll lies in its ability to adapt to your specific requirements. Whether you're a small business owner with a handful of employees or part of a larger HR department, Excel can be customized to fit your unique needs. You can create personalized templates, track various pay components like overtime and bonuses, and easily generate reports for record-keeping or tax purposes.

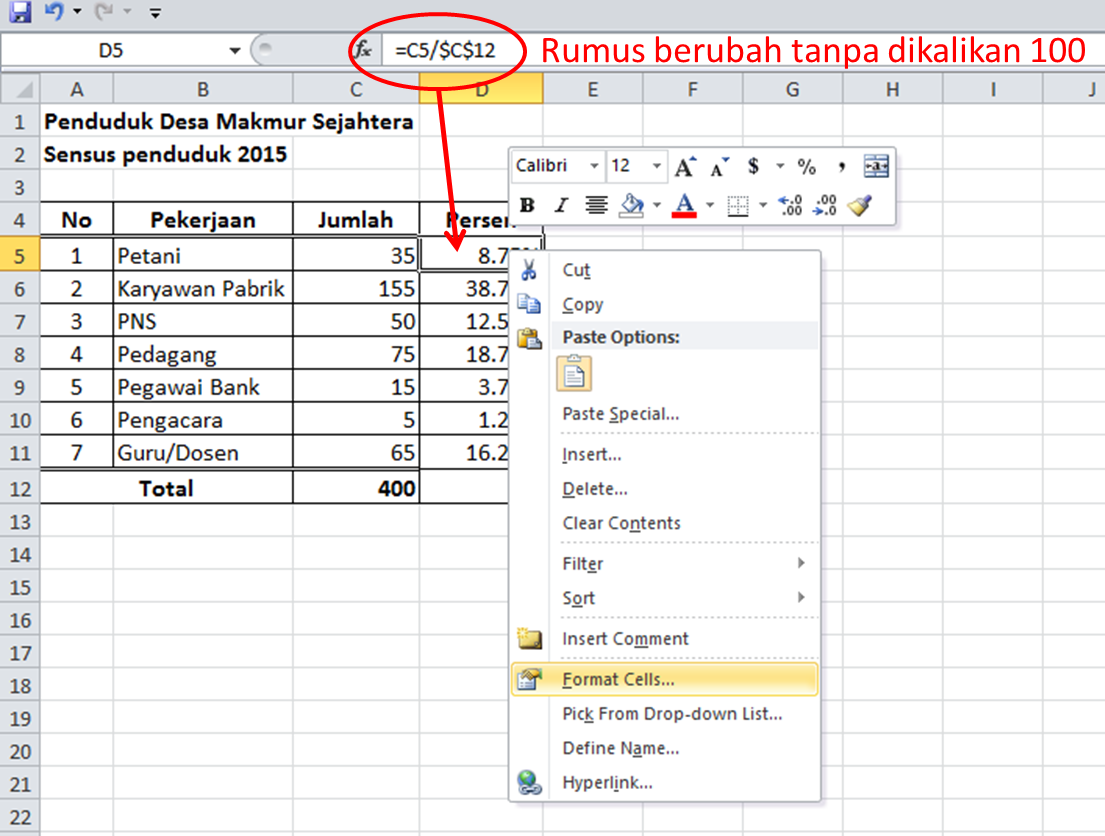

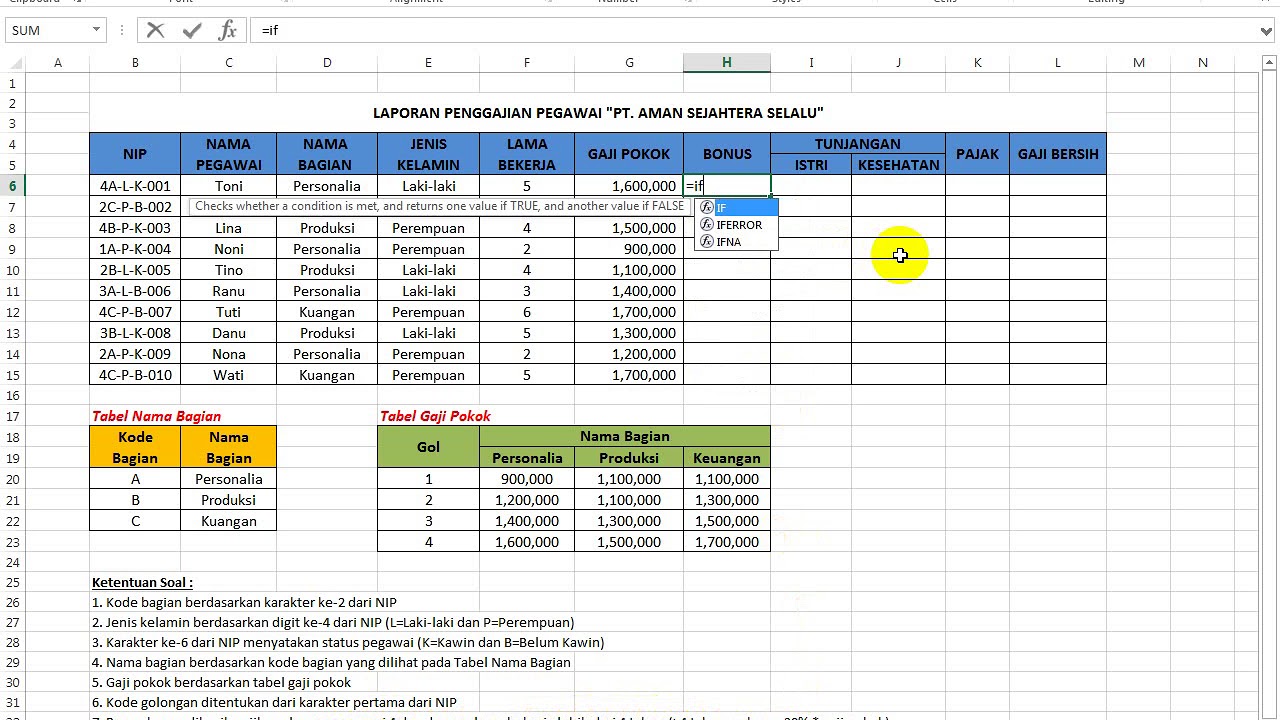

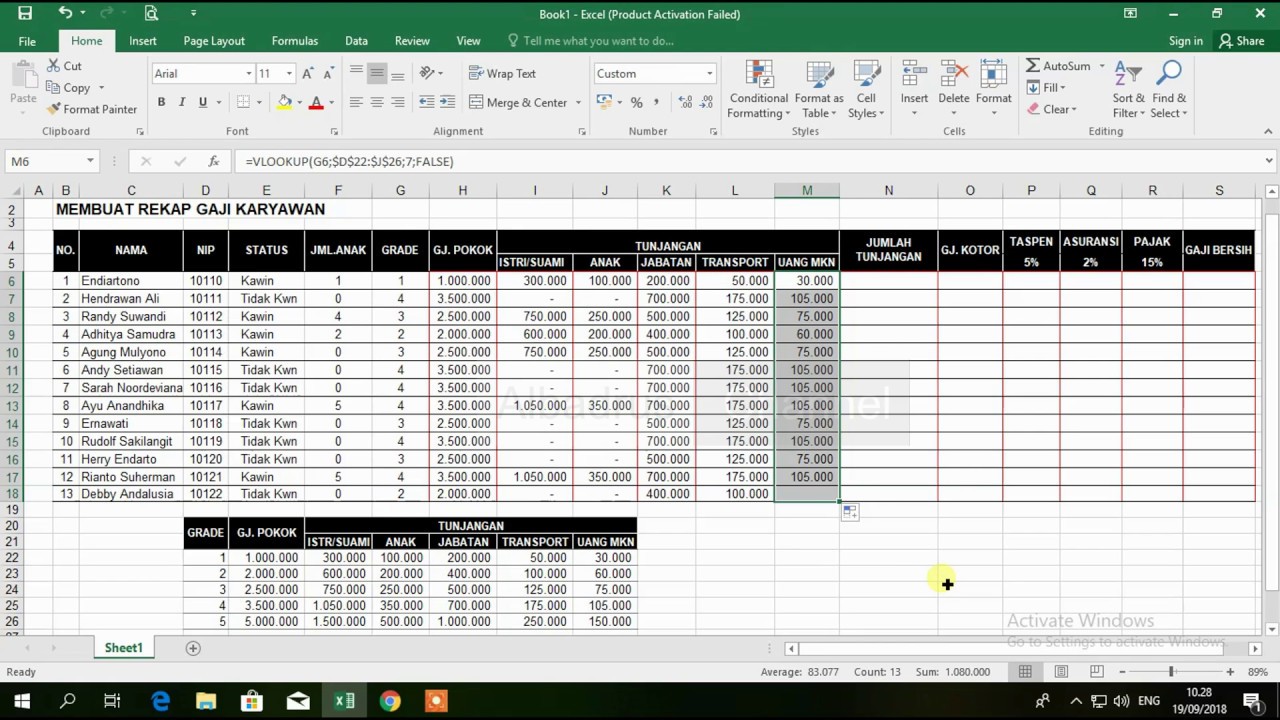

But Excel isn't just about crunching numbers. By mastering the art of formulas and functions, you can transform your spreadsheets into powerful payroll tools. Imagine automatically calculating deductions based on individual tax brackets or generating pay stubs with a click of a button. These are just a few of the possibilities that open up when you harness the full potential of Excel.

As you embark on your journey to Excel payroll mastery, remember that it's a process that builds upon itself. Start with the basics, mastering simple formulas for calculating gross pay and deductions. From there, you can gradually incorporate more advanced functions, exploring features like data validation and conditional formatting to create a robust and error-proof payroll system. The key is to take it one step at a time, celebrating small victories along the way as you build your confidence and expertise.

Advantages and Disadvantages of Calculating Salary in Excel

| Advantages | Disadvantages |

|---|---|

| Cost-effective | Prone to human error |

| Highly customizable | Time-consuming for large payrolls |

| Excellent for data analysis | Security risks if not managed properly |

| Widely accessible software | Requires some Excel knowledge |

While specific formulas and functionalities might vary depending on your country's regulations and company policies, the fundamental principles remain the same. With a little dedication and the right resources, you'll be well on your way to mastering the art of salary calculation in Excel, saving time, reducing errors, and perhaps even discovering a newfound appreciation for the power of spreadsheets along the way.

San wang san francisco unraveling the mystery

Navigating your finances understanding your bank of america account details

Decoding the rainbow your guide to electrical wiring colors