Decoding JPMorgan Chase Wire Transfers: A Comprehensive Guide

Need to send or receive money quickly and securely? Wire transfers are often the go-to solution, especially for larger sums. If you're a JPMorgan Chase customer, or considering using their services, understanding the ins and outs of their wire transfer system is essential. This guide will walk you through everything you need to know about JPMorgan Chase wire information, from the basics to more advanced topics.

Navigating the world of finance can feel overwhelming. Whether you're sending money across the country or around the globe, understanding the specifics of how wire transfers work with your bank is key. With JPMorgan Chase being a major player in the financial world, it's helpful to have a clear picture of their wire transfer procedures and policies. This comprehensive guide is designed to provide that clarity, offering practical advice and answering frequently asked questions.

JPMorgan Chase wire transfers allow you to move funds electronically between accounts, both domestically and internationally. This service is often preferred for its speed and reliability, especially when dealing with significant transactions. However, it's crucial to be aware of associated fees, cut-off times, and security measures. This article will delve into the specifics of Chase's wire transfer services, helping you make informed decisions and avoid potential pitfalls.

Wire transfers are a critical component of modern banking, offering a fast and efficient way to transfer funds. JPMorgan Chase, as a leading financial institution, provides a robust wire transfer platform to its customers. Understanding the details of this service can empower you to manage your finances more effectively, ensuring smooth and secure transactions. This guide aims to equip you with the necessary knowledge to navigate the world of Chase wire transfers.

In today’s fast-paced world, moving money efficiently is paramount. JPMorgan Chase wire transfer services offer a quick and secure method for transferring funds electronically. This article aims to demystify the process, providing you with all the essential information you need to understand Chase wire transfers. We'll cover topics such as domestic and international wires, fees, processing times, and important security considerations.

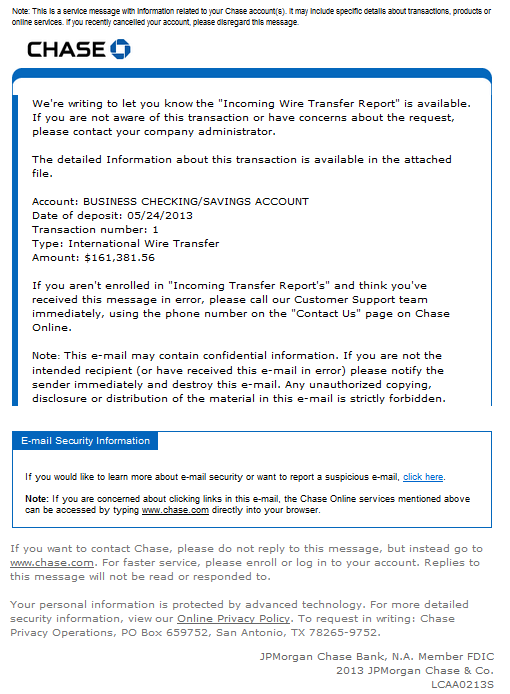

JPMorgan Chase, a product of several mergers and acquisitions throughout history, has a long history of offering wire transfer services. The importance of these services lies in their ability to facilitate large and time-sensitive transactions, playing a crucial role in both personal and business finance. One main issue related to wire transfers is security, which is why Chase employs various measures to protect customers from fraud.

A wire transfer is an electronic transfer of funds. For example, if you need to send $10,000 to purchase a car from a seller across the country, a wire transfer through JPMorgan Chase can facilitate this transaction quickly and securely.

Benefits of using JPMorgan Chase wire information services include speed, security, and global reach. Speed allows for near-instantaneous transfers, especially domestically. Security measures protect your funds from fraud. Global reach enables international transactions, expanding business opportunities and personal financial management capabilities. For instance, you could quickly send funds to a family member overseas in an emergency.

Advantages and Disadvantages of JPMorgan Chase Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversibility |

| Global Reach | Potential for Fraud (if not careful) |

Frequently Asked Questions:

1. What are the fees for a JPMorgan Chase wire transfer? (Answer: Fees vary depending on the type of transfer – domestic vs. international – and whether you initiate the transfer online or in-branch.)

2. How long does a wire transfer take with Chase? (Answer: Domestic wire transfers are often completed on the same business day, whereas international wire transfers can take longer.)

3. How do I initiate a wire transfer with Chase? (Answer: You can initiate a wire transfer online, through the Chase mobile app, or by visiting a branch.)

4. What information do I need to send a wire transfer? (Answer: You'll need the recipient's name, bank name and address, account number, and SWIFT code for international transfers.)

5. Is there a limit on the amount I can wire transfer? (Answer: Limits can vary depending on your account type and transfer method. It's best to contact Chase directly for specific limits.)

6. What are the security measures in place to protect my wire transfer? (Answer: JPMorgan Chase employs various security measures including encryption and fraud monitoring.)

7. How can I track the status of my wire transfer? (Answer: You can usually track the status through your online banking platform or by contacting customer service.)

8. What should I do if I suspect fraudulent activity related to my wire transfer? (Answer: Contact JPMorgan Chase customer service immediately to report any suspicious activity.)

In conclusion, JPMorgan Chase wire transfers provide a powerful tool for moving money quickly and securely. Understanding the specifics of these services, including fees, processing times, and security measures, is crucial for a smooth and successful transfer experience. By utilizing the information provided in this guide, you can navigate the world of Chase wire transfers with confidence. Be sure to contact Chase directly with any specific questions or concerns. Taking the time to familiarize yourself with Chase wire transfer information empowers you to manage your finances effectively and make informed decisions.

Reintegration in coles county supporting returning citizens

Unlocking retro tech your guide to tvs with rca input jacks

Space saving showers seats and corner designs for small bathrooms